I wrote a brief Blackstone (BX) post on December 1 in which I share why negative headlines leading to a decline in BX’s share price present investors with a buying opportunity. When investing in BX, however, an investment must be for the long term.

I say this because of the recent intense focus on the redemptions from Blackstone Real Estate Income Trust (BREIT) and Blackstone Private Credit Fund (BCRED). These fund flows are naturally going to be impacted by market cycles. What BX is currently experiencing is very likely a temporary decline in an otherwise very positive long-term growth trajectory.

Builders and creators of businesses know there will be cyclicality. Inflows to nearly all types of new investments from high-net-worth individuals are likely to decline at some point.

It is so important to invest in well-constructed and historically high-performing products. This is exceedingly important because market downturns often last for relatively short periods and are followed by a resumption of historic trends.

Since the need for very high-quality products in the private wealth channel is very substantial, BX has created highly differentiated offerings in terms of portfolio and performance. As a testament to this, the University of California system reached out to BX and on January 3 it invested $4B in BREIT. On January 25, BX announced that the University of California is investing an additional $0.5B. The structure, terms, and fees for both investments include an effective 6-year minimum hold period.

This is the way you should be thinking when investing in BX. None of this short-term buy, sell, buy, sell, buy, and sell.

With this out of the way, I revisit BX given that it has just released Q4 and FY2022 results.

Business Overview

I encourage investors unfamiliar with BX to review the company’s website and Part 1 of the FY2021 10-K.

The ‘Our Businesses‘ section of BX’s website has a menu of the areas in which BX invests.

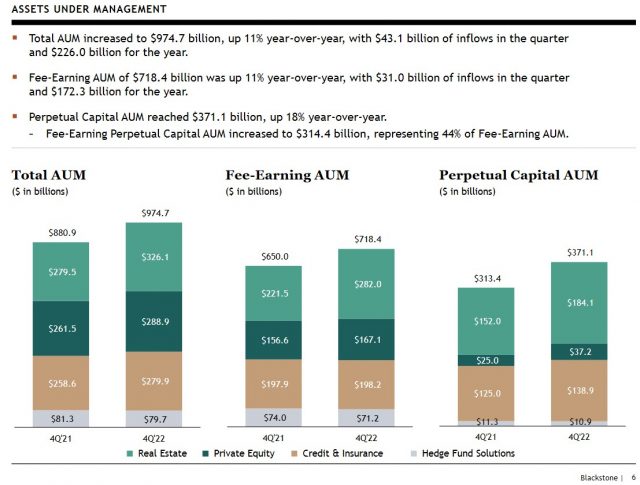

At FYE2022, BX had $974.7B in total Assets Under Management (AUM) versus $880.9B at FYE2021.

Financials

Q4 and FY2022 Results

The most recent results are accessible here and in the accompanying Q4 2022 Supplemental Financial Data. In particular, refer to page 18 of 20.

Given recent economic conditions, it makes sense that the Multiple on Invested Capital (MOIC) and Net IRRs for Unrealized Investments would have been eroded; a good explanation of MOIC is found here.

Refer to BX’s Q2 2022 Supplemental Financial Data and Q3 2022 Supplemental Financial Data for comparison.

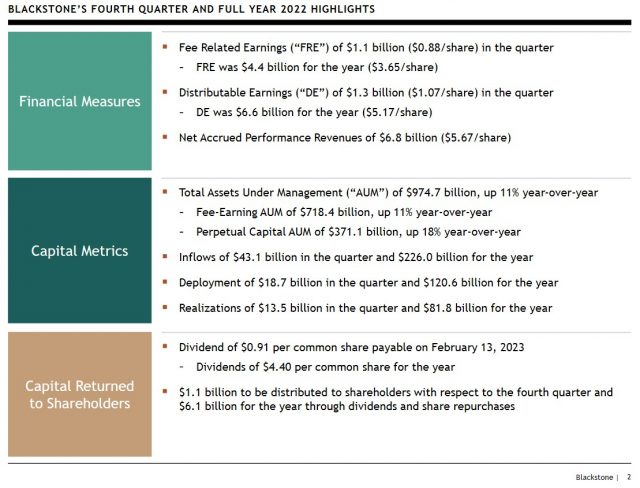

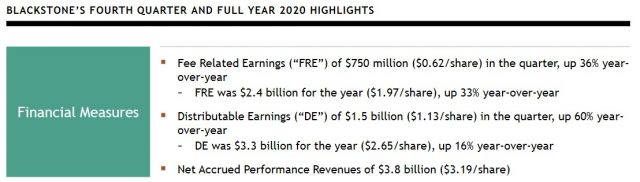

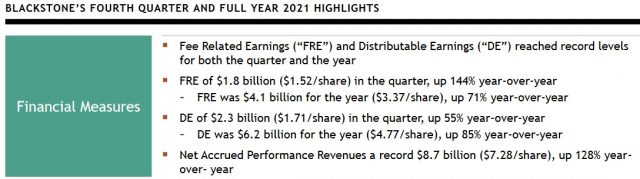

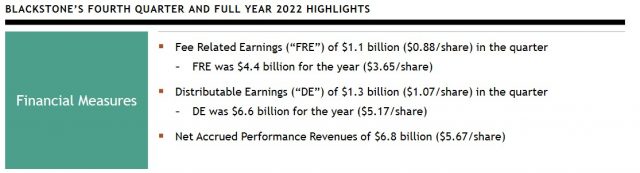

The following is a very high-level overview of BX’s Q4 and FY2022 results.

Source: BX – Q4 2022 Earnings Presentation – January 26, 2023

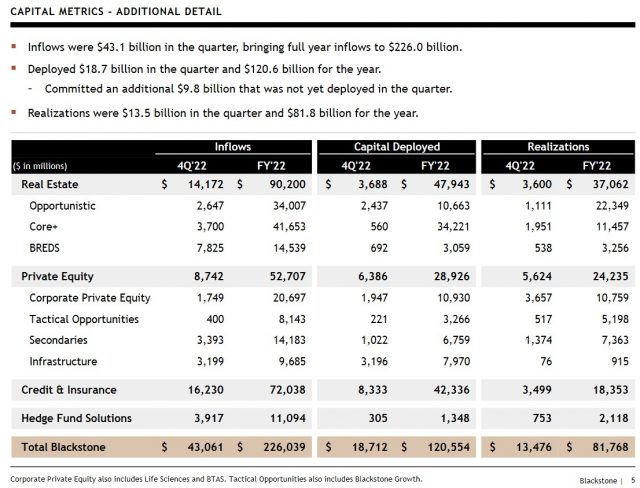

BX has a diverse range of growth engines that enables it to continually generate inflows, deploy capital, and generate realizations.

Source: BX – Q4 2022 Earnings Presentation – January 26, 2023

BX has ~$187B of dry powder which is more capital than almost any other financial investor in the world. This enables BX to opportunistically buy assets when values are low and liquidity is scarce.

Given BX’s concerns around rising interest rates and inflation, it has concentrated over 80% of its current real estate portfolio in sectors where strong cash flow growth could help offset these headwinds. This includes logistics, rental housing, life science office, hotels and data centers.

Logistics is BX’s largest exposure, comprising ~40% of the entire real estate portfolio. Fundamentals globally remain extraordinarily strong. In recent months, re-leasing spreads, the increase in rents as expiring leases roll over, were 65% in BX’s US holdings, accelerating to a record 75% in December, ~50% in the UK, ~30% in Europe overall, ~20% in Australia, and ~100% in Canada.

Furthermore, construction starts for warehouses, along with most types of real estate are falling sharply. This further tightens an already constrained new supply pipeline.

The exceptional fundamentals in the logistics space do not apply everywhere. In traditional US office space, for example, secular challenges have been exacerbated in a post-pandemic world. BX has written down the equity value of traditional US office assets dramatically since 2018. However, such assets represent only 2% of BX’s global real estate portfolio versus ~50% 15 years ago.

On the private equity front, BX’s concentration in the travel and leisure, energy, and energy transition areas has had a meaningful impact on results.

BX largely avoided unprofitable tech and did not invest in crypto.

This thematic approach has led to 14% YoY revenue growth in Q4 for the corporate private equity operating companies.

Margins in BX’s portfolio have proven to be resilient which is a testament to BX’s focus on high-quality businesses with pricing power.

In BX’s non-insurance corporate credit business, there is ~$200B of total AUM. Over 90% of these investments are floating rates which have benefited returns as rates have moved higher.

Fundraising

While the fundraising environment remains challenging, BX is seeing the greatest demand for private credit strategies and infrastructure.

The current environment is also favourable given the significant increases in base rates and wider spreads. BX’s direct origination capabilities are a key differentiator for insurance clients. This is leading to robust growth in this area with $8B of inflows in Q4. This brings AUM to ~$160 and BX expects over $250B over time from existing clients alone. BX recently announced an incremental $1B commitment from Nippon Life, Japan’s leading life insurance company.

In infrastructure, BX raised $3B in Q4 and $10B in FY2022, bringing AUM to ~$35B in 5 years. This area of BX’s business has generated a 19% net return annually since inception.

In BX’s drawdown fund business, it has raised ~$100B for the current vintage of flagships; the target is $150B.

On the corporate private equity front, BX closed over $15B for the new flagship.

In the secondaries, BX recently made the following announcement.

BX has also raised additional capital in Q4 for its renewables and energy transition-focused strategies in credit and private equity, targeting over $10B in aggregate.

In real estate, BX has commenced fundraising for its latest debt vehicle. The expectation is that it will be comparably sized to its $8B predecessor.

In Q1 2023, BX expects to start raising its 7th European opportunistic strategy. The target is for a similar size to the prior fund, which was €9.5B of third-party capital.

BX’s largest commitment in Q4 was for a majority stake in Emerson Electric’s Climate Technologies segment. This $14B transaction was the result of a year-long dialogue and was completed at a time when traditional financing sources were largely unavailable.

While other transactions have been announced in recent months, those reflected above provide a snapshot of the interesting opportunities that arise from market dislocation.

FY2023 Outlook

Management expects sales activity to remain muted in the near-term given market conditions. The expectation is that realizations will accelerate when markets ultimately stabilize.

On the Fee-Related Earnings (FRE) front, BX expects a material step-up over the next several years. This will be led by:

- BX’s drawdown fundraising cycle;

- expanding contribution from perpetual strategies; and

- the substantial largely contractual growth of BX’s dedicated insurance platform.

In terms of the drawdown funds, the fee holiday for BX’s global real estate flagship has ended. The 2023 results will include a nearly full-year contribution of management fees.

BX expects to launch the investment period for the corporate Private Equity flagship fund later in 2023. Once funds are deployed there will be a four-month fee holiday.

Furthermore, various other funds will be launched in the coming quarters.

As of FYE2022, only $56B of BX’s $150B target was earning management fees. The number of strategies continues to grow in number and scale with currently over 50 discrete vehicles which set a substantially higher baseline for fee revenues in FY2023.

In addition to net asset value-based management fees, over 30 of the perpetual vehicles are eligible to generate fee-related performance revenues.

Blackstone Property Partners (BPP) also has 4 times more AUM subject to crystallization in 2023 with most occurring in the 2nd half of the year.

In insurance, BX ended FY2022 with over $100B in AUM from 4 large clients which generate ~$0.45B of annual management fee revenue. As these mandates grow over time, BX anticipates fee revenues will more than double to ~$1B in 4 – 5 years.

Credit Ratings

BX’s senior unsecured domestic long-term debt ratings are at the top of the upper-medium-grade investment-grade tier. There is no change from prior reviews.

- S&P Global assigns an A+ long-term unsecured debt credit rating with a stable outlook; and

- Fitch assigns an A+ long-term unsecured debt credit rating with a stable outlook;

These ratings define BX as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

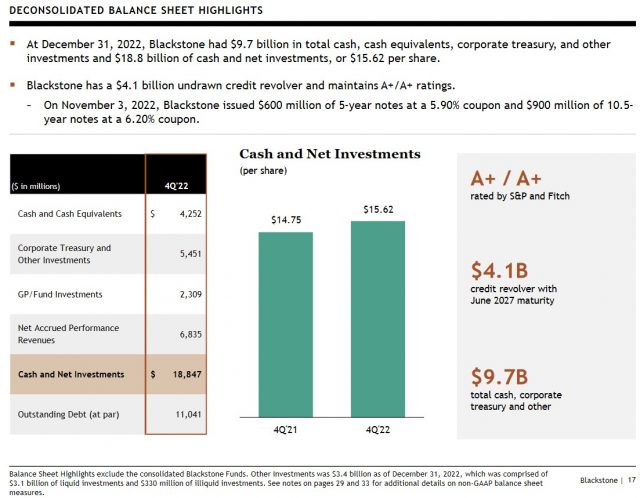

These are BX’s deconsolidated Balance Sheet highlights for Q4 2021 and 2022.

Source: BX – Q4 2022 Earnings Presentation – January 26, 2023

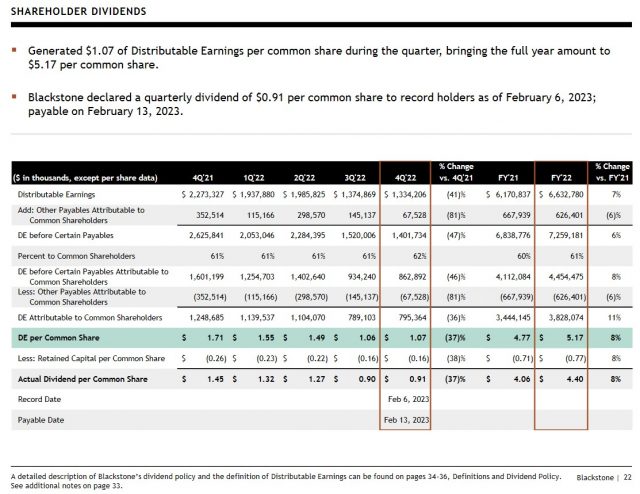

Dividends and Share Repurchases

Dividend and Dividend Yield

Investors should not fixate on dividend metrics. It is preferable to look at an investment’s total potential long-term return perspective (capital gains and dividend income).

BX’s dividend policy is based on Distributable Earnings (DE):

‘We intend to pay to holders of common stock a quarterly dividend representing approximately 85% of The Blackstone Group Inc.’s share of Distributable Earnings, subject to adjustment by amounts determined by our board of directors to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and funds, to comply with applicable law, any of our debt instruments or other agreements, or to provide for future cash requirements such as tax-related payments, clawback obligations and dividends to shareholders for any ensuing quarter. The dividend amount could also be adjusted upward in any one quarter.’

On January 26, 2023, BX declared a $0.91/share quarterly dividend payable on February 13. BX’s quarterly dividend fluctuates so investors should not try to calculate BX’s forward dividend yield.

Source: BX – Q4 2022 Earnings Presentation – January 26, 2023

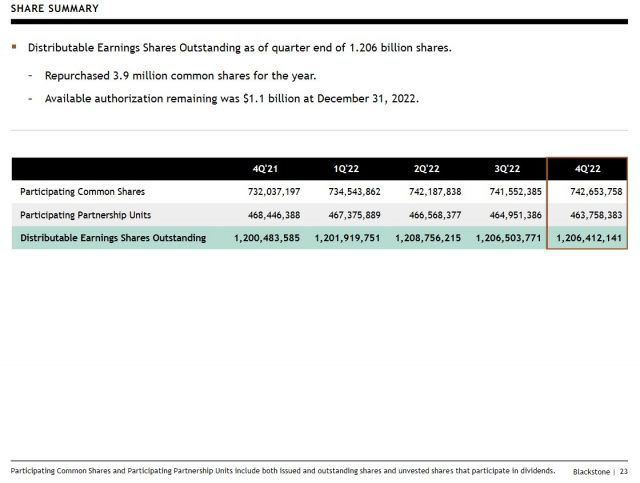

Share Repurchases

BX is hyper-focused on capital allocation. The extent to which it repurchases shares depend on whether there is a meaningful deterioration in BX’s share price relative to the true underlying value.

Despite an increase in the number of outstanding shares since Q1 2021, my interest lies in knowing that the underlying value of each share shall likely appreciate over the long term.

Source: BX – Q4 2022 Earnings Presentation – January 26, 2023

BX has distributed $6.1B over the last 12 months when we include the FY2022 share repurchases and the Q4 dividend payable in February.

Valuation

As explained in previous BX posts, I typically look at:

- diluted EPS;

- adjusted diluted EPS; and

- Free Cash Flow (FCF)

metrics to gauge the valuation of most companies I analyze. These metrics, however, are of little relevance when trying to assess BX’s performance and outlook.

BX uses Distributable Earnings (DE) and Fee Related Earnings (FRE) to more accurately measure its performance; these, and other terms, are defined at the end of the Q4 2022 Earnings Presentation and within the FY2021 Form 10-K.

The very manner in which BX operates makes it virtually impossible to estimate future DE and FRE. Furthermore, BX does not provide guidance.

The reason BX is not easy to value is that it raises large pools of capital from clients for deployment thus resulting in multiple multi-billion-dollar acquisitions annually. Because it continually makes sizable investment transactions (acquisitions or divestitures), earnings estimates can quickly become outdated.

Some of the acquired assets are meant to be perpetual holdings. In other cases, BX uses its expertise to improve the performance of the companies in which it invests with the intent of monetizing these assets as part of its capital recycling programs. It is not, therefore, unusual to see wide swings in YoY GAAP results.

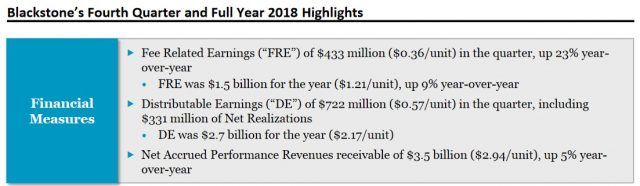

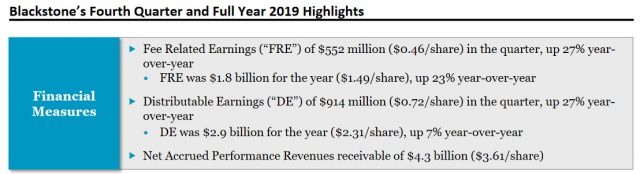

Looking at DE and FRE results extracted from the FYE 2017 – FY2022 Earnings Presentations, we see that BX generates impressive results.

Final Thoughts

I have neither the time nor the interest in managing individual alternative assets, and therefore, invest in BX and the Brookfield group of companies to have exposure to ‘Alternative Assets’.

Currently, 1341 BX shares are held in a ‘Core’ account in the FFJ Portfolio. This exposure will grow with the automatic reinvestment of the quarterly dividend income.

I expect BX will reward long-term shareholders and recommend acquiring shares on weakness. However, as noted at the outset of this post, BX’s investments are long-term in nature. You must, therefore:

- have a long-term time horizon; and

- be prepared to withstand the ‘down’ portion of the market cycles.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long BX.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.