Summary

- MMM lowered its FY2018 EPS guidance when it released its Q3 2018 results in October.

- FY2019 EPS guidance provided at its November Investor Day been lowered to $10.45 – $10.90 which still represents a 17.5% – 22.6% YoY increase from the $8.89 earned in FY2018.

- The company consistently generates significant Free Cash Flow.

- Another dividend increase is likely to be announced within the week which will mark the 60th consecutive year in which MMM has increased its dividend.

- MMM is encountering headwinds and while it is projecting aggressive EPS growth I am of the opinion that it is not attractively valued.

- A market pullback similar to that experienced in December should not be ruled out and if MMM’s share price once again retraces to $180 or below I would consider acquiring additional shares.

Introduction

I previously covered 3M (MMM) in ‘One of My Top 5 Largest Holdings Helps Me Sleep Well’ and followed that up with ‘Don’t Give Up on This Great Company’. In my ‘Don’t Give Up’ article, I listed various macro headwinds I expected we would encounter. This led me to believe that we would experience heightened volatility and opportunities in which to acquire MMM shares at more attractive valuations.

When I wrote my October 23rd article I indicated that I am already overweight MMM and would only be acquiring additional shares (low double digits quarterly) through the automatic reinvestment of the quarterly dividends. When MMM’s share price plunged to the $180ish level just before Christmas, however, the attractive valuation proved too good to pass up. I, therefore, acquired just a few additional shares for one of our undisclosed retirement accounts.

With MMM having held its Investor Day in mid-November 2018 and having released Q4 and FY2018 results and FY2019 guidance on January 29, 2019 I am now taking this opportunity to revisit MMM.

November 2018 Investor Day

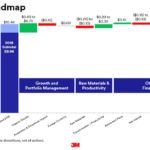

On November 15th, MMM’s CEO introduced the company’s priorities for the future and provided 5-year financial targets.

MMM – Long-Term Financial Objectives

MMM – Investor Day Presentation – November 15 2018

Local currency growth targets by business during the 2019 – 2023 timeframe are:

- Health Care: 4 – 6%

- Safety & Graphics: 3 – 6%

- Industrial: 3 – 5%

- Electronics & Energy: 2 – 6%

- Consumer: 2 – 4%

Overall total growth of 3 – 5% is forecast with target growth by region as follows:

- USA: 3 – 4%

- EMEA (Europe, Middle East, Africa): 2 – 4%

- Asia Pacific: 4 – 7%

- Latin America/Canada: 2 – 6%

Management has indicated that it is targeting a 200 – 300 bps operating margin improvement by 2023 with 100 – 200 bps to come from a gross margin improvement and ~100 bps to come from SG&A efficiencies.

Funding for MMM’s future capital needs will come from:

- Strong cash flow growth primarily from business growth and added cash flow from acquisitions: $55B – $65B;

- Incremental net debt and a further optimization of MMM’s capital structure and a reduction in the cost of capital: $5 – $15B.

Management has reiterated its commitment to dividend growth and share repurchases.

MMM – Balanced Capital Allocation Plan

FY2018 Outlook as at end of Q2 (July 24, 2018) and Q3 (October 23, 2018)

At the time of my July 24th article, MMM had just provided the following guidance:

- GAAP EPS of $9.08 – $9.38 versus the previous $8.63 – $9.08 representing a 15% – 18% YoY increase;

- Adjusted EPS of $10.20 – $10.45 versus the previous $10.20 – $10.55.

Source: MMM – Q3 2018 Earnings Presentation July 24 2018

Source: MMM – Q3 2018 Earnings Presentation July 24 2018

When I wrote my October 23, 2018 article, MMM had just lowered its guidance:

- GAAP EPS of $8.78 – $8.93 versus the previous $9.08 – $9.38 representing an 11% – 13% YoY increase;

- Adjusted EPS of $9.90 – $10.00 versus the previous $10.20 to $10.45.

Source: MMM – Q3 2018 Earnings Presentation October 23 2018

Q4 and FY2018 Results

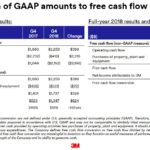

Let’s see how the previous guidance compares with the actual FY2018 results MMM released on January 29th.

MMM’s Q4 and FY2018 Earnings release can be found here.

We see that MMM’s GAAP EPS was $8.89 representing a 12.1% YoY increase.

Source: MMM – Q4 and FY2018 Earnings Presentation January 29 2019

FY2019 Guidance

Subsequent to MMM’s 2018 Investor Day in mid-November there has been slowdown in key end markets, with the biggest impact coming from China, automotive and electronics. As a result of this slowdown, MMM has widened the range for expected organic growth to 1% – 4% versus the prior range of 2% – 4%.

MMM’s guidance now calls for 2019 GAAP EPS of $10.45 – $10.90 (a 17.5% – 22.6% YoY increase) against the previous range of $10.60 – $11.05. This revised guidance includes a $0.10 earnings headwind from the M*Modal acquisition whereas the prior guidance did not since the M*Modal acquisition announcement was made in mid-December.

The expected return on invested capital remains at 22% – 25%.

Source: MMM – Q4 and FY2018 Earnings Presentation January 29 2019

Free Cash Flow (FCF)

In its Q2 2018 presentation MMM forecast FCF conversion of 90% – 100%. This was revised to 90% – 95% when Q3 results were released. With the release of FY2018 results we see that MMM achieved a 91% FCF conversion.

MMM is now projecting GAAP earnings to FCF conversion for FY2019 to be superior to that reported in FY2018.

Source: MMM – Q4 and FY2018 Earnings Presentation January 29 2019

In my October 23rd article I provided an explanation of the term ‘FCF conversion’. I once again provide it below for ease of reference.

FCF it is a measure of the ability of a company to convert (in the same period) accrual-based accounting earnings that the business generates to actual cash that is available to:

- deploy in business acquisitions;

- reduce net debt (by increasing book cash or reducing actual gross debt);

- return to shareholders in the form of cash dividends or stock buybacks.

FCF Conversion is equal to the Company’s free cash flow for a given period divided by net earnings for the same period, subject to adjustment for extraordinary items, non-operating items, discontinued operations, asset write-downs and impairments and other unusual and non-recurring items, currency fluctuations, financing activities, acquisitions and acquisition expenses, divestitures and divestiture expenses and the effects of tax or accounting changes.

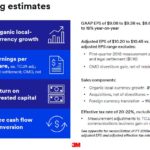

Key Planning Assumptions

On the January 29th call with analysts MMM indicated that most of its key planning assumptions for 2019 remain unchanged from what was disclosed at the November 15th Investor Day. The following 3 changes, however, have been made.

- the full year organic growth range has been expanded to 1% – 4% versus the prior range of 2% – 4%;

- December’s market volatility lowered MMM’s 2019 earnings benefit versus expectations in November which has negatively impacted MMM’s global pension expense;

- projections now include the estimated full year growth and earnings impact from the pending M*Modal acquisition (see below for more information).

MMM is now forecasting full year foreign currency translation to be a 1% headwind to sales but neutral to earnings.

On the raw materials front, MMM anticipates higher YoY costs, including tariff impacts. It does, however, continue to expect selling prices, along with the global sourcing team’s ongoing productivity efforts, to more than offset the expected raw material headwinds.

The 2019 impact from the pending M*Modal acquisition, net of the communication markets divestiture, is expected to be neutral to sales and an earnings headwind of $0.15/share.

Efforts to accelerate benefits from transformation, portfolio and footprint optimization, along with manufacturing and SG&A productivity are ongoing.

Source: MMM – Q4 and FY2018 Earnings Presentation January 29 2019

On the capital allocation front, MMM’s strong operational cash flow fuels its capital allocation plan. MMM expects to generate $9.5B – $10.5B from operations prior to any investments in R&D and the global pension plans.

When MMM includes cash, marketable securities and added leverage, the 2019 plan calls for $14.5B – $16.5B of available capital.

Capital deployment has been prioritized as follows:

- Invest in the business (includes R&D and CapEx)

- Return cash to shareholders in the form of dividends and share repurchases.

Source: MMM – Q4 and FY2018 Earnings Presentation January 29 2019

4 Priorities

MMM continues to position itself for long-term growth and value creation which includes executing on its 4 priorities.

Strengthening the Portfolio

This entails an ongoing review and reshaping of the portfolio through divestitures and acquisitions.

MMM – Investor Day Presentation – November 15 2018

Two years ago MMM decided to retain and further invest in its health information systems business.

In December 2018, MMM announced that it had entered into a definitive agreement to acquire the technology business of M*Modal for $1B. M*Modal is a leading healthcare technology provider of cloud-based, conversational Artificial Intelligence (AI)-powered systems that help physicians efficiently capture and improve the patient narrative so they can spend more time with their patients and provide higher quality of care.

This transaction is expected to close in Q1 and its impact is reflected in MMM’s updated guidance for 2019.

Transformation

This involves improving how MMM serves its customers, how it works, and how it competes.

In 2018, MMM executed an ERP deployment across all 5 business groups in the United States; the US accounts for nearly 40% of global sales. With the U.S. rollout, MMM has deployed approximately 70% of its global revenue on the new ERP system.

Innovation

Innovation is fundamental to MMM’s organic growth and is key to its long track record of delivering premium margins and return on invested capital. In 2018, MMM continued to invest in both R&D and CapEx, with accelerated investments in the priority growth platforms focused around health care, transportation, safety and infrastructure.

People and Culture

In 2018, MMM expanded development opportunities for its employees while launching initiatives to deepen the company’s commitment to sustainability, diversity, and inclusion.

MMM also earned a number of external recognitions, including being named one of the world’s most ethical companies for the 5th straight year.

Credit Ratings

Moody’s continues to rate MMM’s senior unsecured debt A1 (upper tier of the ‘upper medium grade’ rating).

S&P Global continues to rate MMM’s senior unsecured debt AA- (lowest tier of the ‘high grade’ rating).

Neither agency has MMM’s credit ratings under review.

These attractive credit ratings confirm neither agency is of the opinion MMM will have difficulty in servicing its obligations.

Valuation

At the time of my October 23rd article MMM had revised downward its GAAP EPS to $8.78 – $8.93 and Adjusted EPS to $9.90 – $10.00. MMM had closed at $192.55 on October 23rd giving us a forward PE range of ~21.56 – ~21.93 and a forward adjusted PE range of ~19.26 – ~19.45.

With MMM’s FY2018 GAAP EPS of $8.89 and a current $199.27 share price we have MMM trading at a ~22.42 PE. This is comparable to 2013 – 2017 PE levels which were 21.6, 22.5, 19.5, 22.5, and 26.2.

MMM’s guidance now calls for 2019 GAAP EPS of $10.45 – $10.90 and with the January 30th closing share price of $199.27 we get a forward PE range of ~18.28 – ~19.07.

Dividend, Dividend Yield, and Dividend Payout Ratio

MMM’s dividend history can be found here and its stock split history can be found here.

MMM’s balanced capital allocation plan calls for the dividend to grow in-line with earnings over time. We know that FY2017 EPS was $7.93 and FY2018 EPS was $8.89; this is a ~12% increase in EPS. If we take the low end of MMM’s FY2019 EPS guidance which is $10.45, this represents a ~17.5% increase from FY2018 EPS of $8.89.

The dividend is to grow in-line with earnings over time but a ~17.5% increase in MMM’s dividend strikes me as too high and I am leaning toward a ~10% increase. This would result in the current $1.36 quarterly dividend being increased to ~$1.50/quarter or $6/year. A $6 annual dividend would provide investors with a ~3% forward dividend yield based on the current $199.27 share price.

I expect MMM will announce a dividend increase within the week.

Share Repurchases

Share repurchases have been deemed as one of the ways in which MMM will reward shareholders. In fact, the 2019 capital allocation plan calls for $2B – $4B in gross share repurchases with the actual amount being influenced by relative value and demands on capital.

MMM has certainly reduced share count with the weighted average number of diluted MMM common shares outstanding for FY2007 being ~732 million and for FY2018 being ~602 million.

Final Thoughts

MMM has been a core holding on mine for over 15 years and I fully intend to retain it as a core holding.

MMM has encountered headwinds in the past and management has steered the company appropriately. I have no reason to suspect that management will do otherwise going forward.

In my opinion MMM is currently slightly expensive. I am of the opinion that another broad market pullback, similar to that in December, will occur in the not too distant future. As a result, I think patient investors will have an opportunity to acquire MMM shares at a valuation that is superior to the current level.

In my opinion, a price below ~$180 is when I would consider adding to my existing MMM position.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long MMM.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.