I have Thermo Fisher Scientific (TMO) exposure but it is on my ‘Watch’ list since I think there will be an opportunity to acquire shares at a more favorable valuation within the next 12 months.

I last reviewed TMO in this July 26, 2024 post at which time I concluded that shares were overvalued. Now that we have TMO’s Q3 and YTD2024 results and a very minor revision to the FY2024 outlook, I revisit this existing holding.

Business Overview

I reviewed material presented at TMO’s 2023 Investor Day in my May 24, 2023 post. I, however, recommend reviewing the company’s website and Part 1, Item 1 in the FY2023 Annual Report and Form 10-K to gain a good understanding of the business.

TMO is arguably the premier life science supplier. Its portfolio of products, resources, and manufacturing capabilities is unmatched. This has allowed it to increase its ‘share of wallet’ across all channels.

Diagnostic and research companies such as TMO, Danaher (DHR), and Agilent (A) have been operating in a budget-constrained environment. This has negatively impacted their performance in the short term. These constraints should eventually ease at which time I expect all three companies will report improved results.

Financials

Q3 and YTD2024 Results

The Q3 2024 Earnings Release and Form 10-Q are accessible here. In addition, I recommend reviewing the Q3 2024 GAAP/Non-GAAP Reconciliation & Financial Information.

Operating Cash Flow (OCF), CAPEX, and Free Cash Flow (FCF)

In the FY2014 – FY2023 time frame, TMO’s:

- OCF was (in B$) 2.62, 2.82, 3.16, 4.01, 4.54, 4.97, 8.29, 9.31, 9.15, and 8.41.

- CAPEX was (in B$) 0.43, 0.42, 0.44, 0.51, 0.76, 0.93, 1.47, 2.52, 2.24, and 1.48.

- FCF was (in B$) 1.98, 2.80, 2.90, 2.80, 4.26, 4.66, 7.11, 8.30, 7.92, and 7.42.

Historically, I have not deducted the stock based compensation (SBC) reflected in the Consolidated Statements of Cash Flows to determine OCF and FCF; the figures reflected above do not deduct TMO’s annual SBC.

After giving the matter much consideration, I am going to start adjusting a company’s OCF so that SBC is NOT added back. My reasoning for doing so is covered in my How Stock Based Compensation Distorts Free Cash Flow post. By making this adjustment, my OCF and FCF will differ from many other online sources going forward including the figures provided by TMO; my figures will be more conservative.

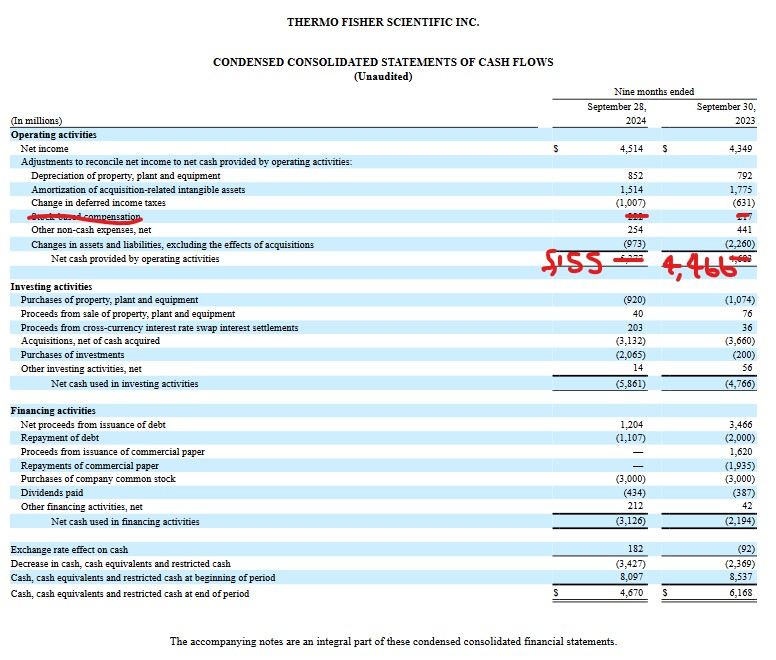

In the 9 months ending September 30, 2023 and 2024, TMO’s OCF is reduced to $4.466B from $4.683B and $5.155B from $5.377B as SBC was $0.217B and $0.222B.

If we deduct $0.998B which is the net change in property, plant, and equipment in 2023, we get YTD FCF of $3.468B.

If we deduct $0.880B which is the net change in property, plant, and equipment in 2024, we get YTD FCF of $4.275B. TMO calculates its YTD2024 FCF as being $4.497B.

Return On Invested Capital (ROIC)

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

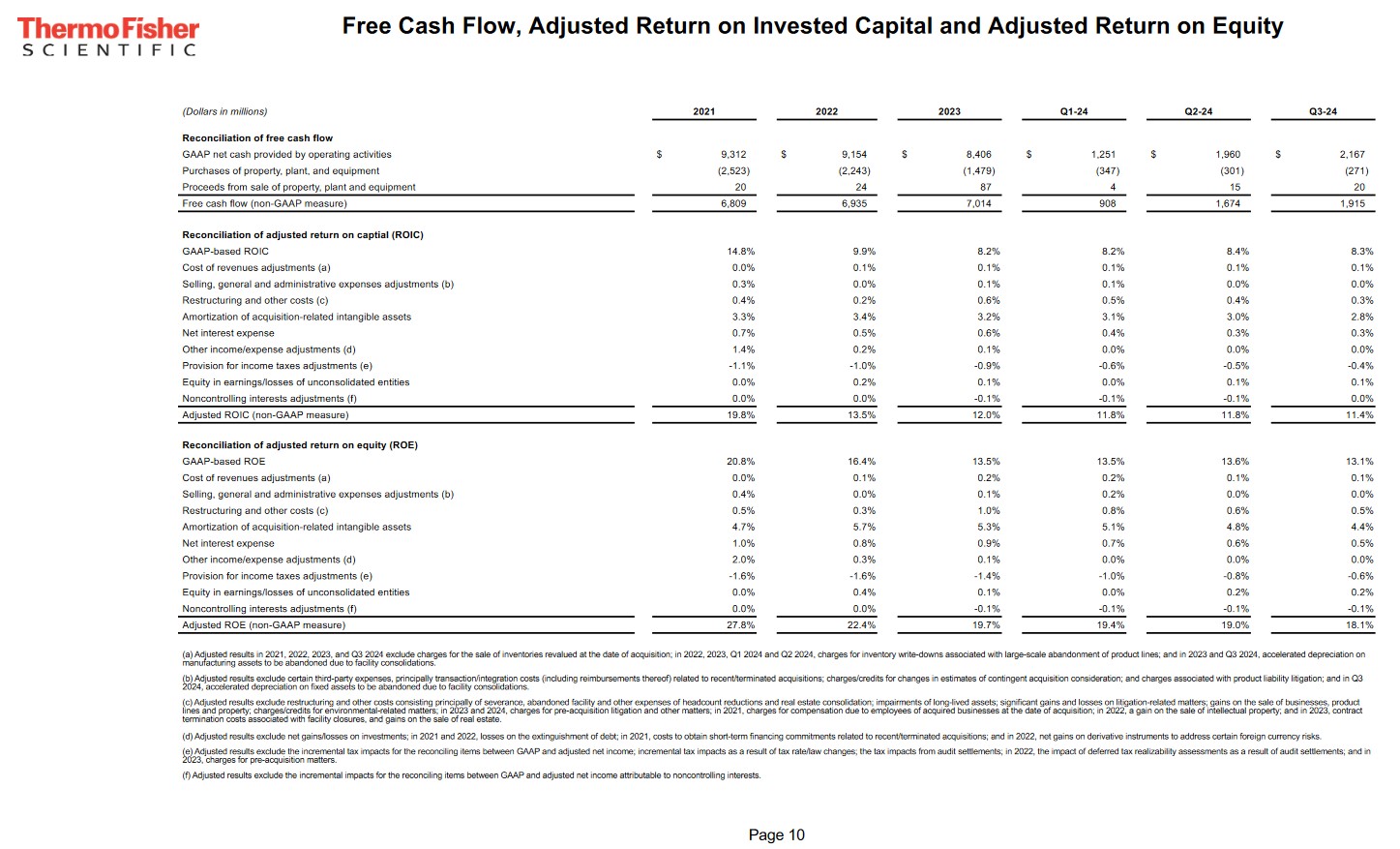

TMO makes various adjustments (see schedule below) to arrive at its adjusted ROIC (%). In FY2013 – FY2023 its adjusted ROIC was 10.1, 9.5, 9.5,9.9, 10, 10.9, 11.8, 17.9, 19.8, 13.5, and 12.0. In Q1, Q2, and Q3 2024 it was 11.8, 11.8, and 11.4.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company’s cost of capital will be lower than this level. TMO’s ROIC falls short of this level but, for the most part, the adjusted ROIC has been in the low double digits over the past decade.

When a company consistently generates a high ROIC over the long term and it is growing its revenue, it can reinvest a portion of its profits under favorable conditions thereby leading to a compounding effect. I would much rather invest in a growing company that can reinvest to create greater shareholder value than to invest in a company that has limited growth opportunities and thus chooses to distribute a growing dividend.

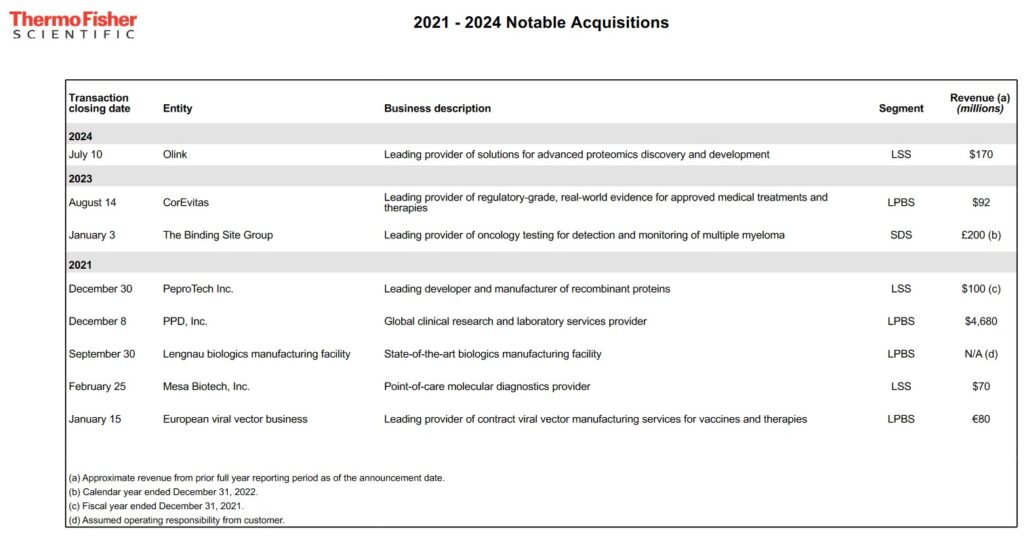

TMO’s goal has been to be the leading provider of life science instruments and consumables. In order to achieve this goal, it has invested heavily and has also made multiple acquisitions; the following schedule reflects some of TMO’s most notable recent acquisitions.

Since 2010, TMO has deployed more than $50B on acquisitions (on average $4.7B/year). While this has significantly increased TMO’s scale, product breadth, and reach, it has suppressed its ROIC. Although TMO will undoubtedly continue to be acquisitive, it is so large relative to its peer group that there are few acquisition opportunities that would be sufficiently large to materially impact its ROIC.

TMO’s current market cap is ~$218B. The next largest company in this space is Danaher (DHR) with a market cap of ~$180B. Next is Agilent (A) at ~$41B.

FY2024 Guidance

TMO is raising its full-year adjusted EPS guidance to $21.35 – $22.07 from the prior guidance of $21.29 – $22.07. Revenue guidance continues to be $42.4B – $43.3B.

This revenue guidance continues to assume that core organic revenue growth will be -1% to 1% for 2024.

The adjusted operating income margin of 22.5% – 22.8% remains unchanged from the prior quarter.

And we now expect net interest cost to be in the range of $340 million to $380 million for the year.

The FY2024 net interest cost assumption is now ~$0.34B – $0.38B versus the prior guidance of ~$0.38B – ~$0.4B.

Management continues to expect a ~10.5% adjusted income tax rate for the year.

The CAPEX guidance is $1.3B – $1.5B and the assumption is for $6.5B – $7B of FCF; this is unchanged from prior guidance.

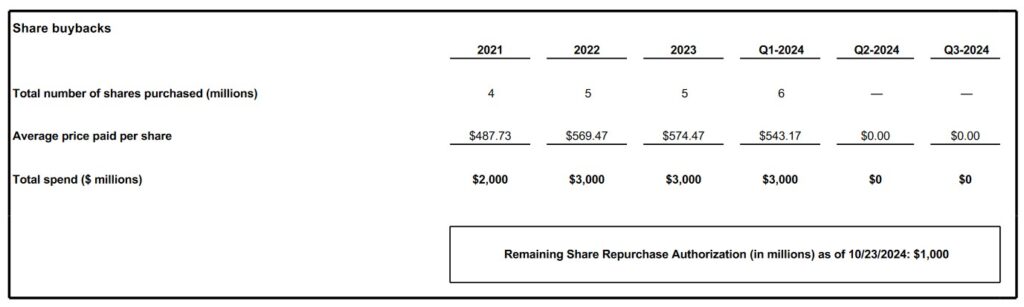

Guidance assumes $3B of share buybacks; this was completed in January.

The estimate is for the full year average diluted share count to be ~383 million shares.

There is no change in the assumption that ~$0.6B of dividends will be distributed in FY2024.

On the Q3 earnings call, management stated:

As you think about the outlook for the year, you should consider the midpoint of our guidance range as the current view of the most likely outcome for the year. Implied in that midpoint is Q4 revenue of $11.3B and adjusted EPS of $5.96. That would reflect 2.5% organic revenue growth for the fourth quarter, which is unchanged from the previous guidance, and is a continuation of our sequential increase in growth that we delivered each quarter throughout the year. And as a reminder, Q4 organic revenue growth has the benefit of 2 extra selling days. which equates to approximately 1% and a headwind from vaccines and therapies of approximately 2.5%.

Credit Ratings

There are no changes to TMO’s domestic unsecured long-term debt ratings from the time of my prior review.

- Moody’s continues to assign an A3 rating with a stable outlook.

- S&P Global continues to assign an A- rating with a stable outlook.

- Fitch continues to assign an A- rating with a stable outlook.

All three ratings are the bottom tier of the upper medium grade investment grade category. They define TMO as having a strong capacity to meet its financial commitments. TMO, however, is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

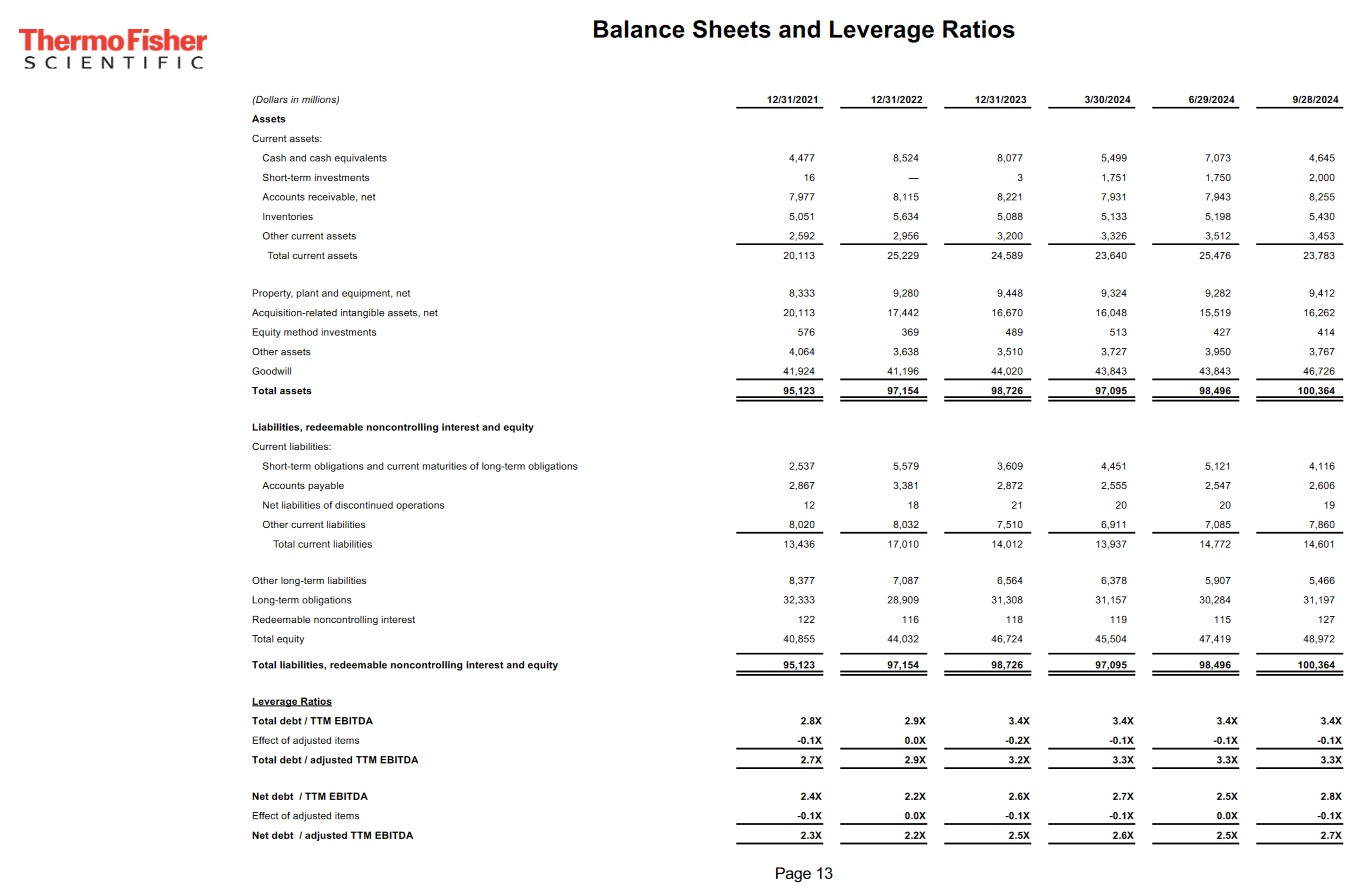

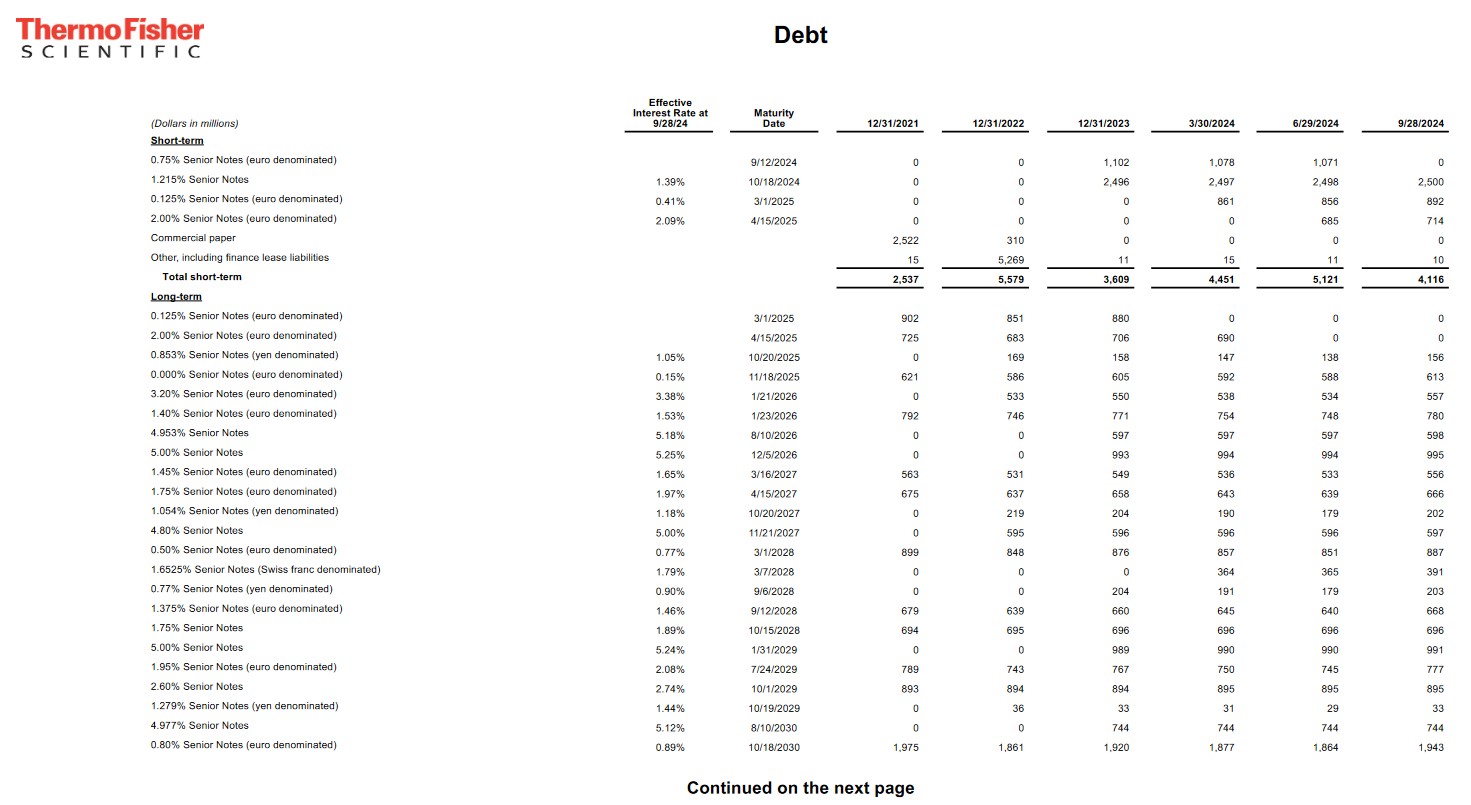

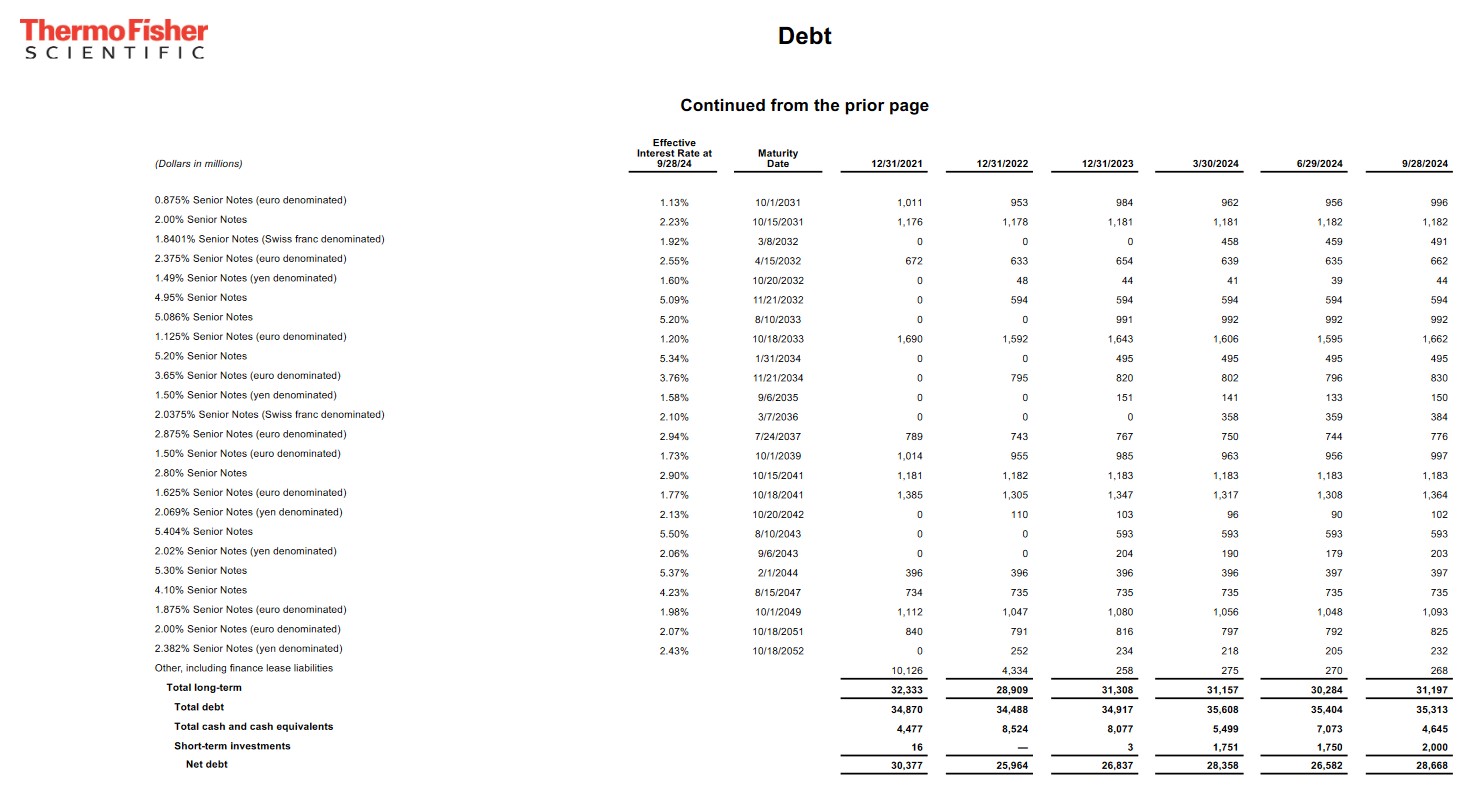

The following schedule reflects a relatively consistent net debt/adjusted trailing 12 month EBITDA ratio.

TMO’s debt maturity schedule reflects ~$4.116B of short-term debt. I do not foresee a problem in the repayment of these obligations.

Dividend and Dividend Yield

TMO’s dividend history is accessible here.

I know past performance is not necessarily indicative of future performance. However, dividends are low on TMO’s list of capital allocation priorities and this is unlikely to change in the foreseeable future.

When considering TMO as a potential investment, disregard the dividend metrics as they are irrelevant.

The following table reflects TMO’s share buybacks in FY2021 – FY2023 and Q1, Q2, and Q3 2024.

The weighted average diluted shares outstanding in FY2013 – FY2023 (in millions) were 366, 402, 402, 397, 398, 406, 403, 399, 397, 394, and 388. At the end of Q3, this had been reduced to 384.

Stock Splits

TMO had three 3 for 2 stock splits in the 1990s (1993, 1995, and 1996).

Valuation

In my July 26, 2024 post, I provided my take on TMO’s valuation at the time of prior posts. I, therefore, refrain from repeating all this information. Nevertheless, I do provide my most recent prior estimated valuation for comparison.

At the time of my July 26 post, TMO had revised its adjusted EPS guidance to $21.29 – $22.07. Using the ~$608 share price when I wrote that post, the forward adjusted diluted PE was ~27.5 – ~28.6.

I also indicated that downward revisions were made to the forward-adjusted diluted broker estimates following the earnings release and I anticipated more downward revisions over the coming days. Using the currently available estimates, however, TMO’s forward-adjusted diluted PE levels were:

- FY2024 – 26 brokers – a forward-adjusted diluted PE of ~28 using a mean of $21.74 and low/high of $21.54 – $21.95.

- FY2025 – 27 brokers – a forward-adjusted diluted PE of ~25.4 using a mean of $23.96 and low/high of $21.55 – $25.37.

- FY2026 – 21 brokers – a forward-adjusted diluted PE of ~22.6 using a mean of $26.85 and low/high of $22.61 – $28.80.

TMO’s FY2024 FCF and weighted average diluted shares outstanding outlook assumptions were for $6.5B – $7B of FCF and ~383 million shares. Dividing the FCF assumption by ~383 million shares resulted in a FCF/share range of ~$17 – ~$18.3. Using the ~$608 share price, the forward P/FCF was ~33.2 – ~35.8.

Shares now trade at ~$558 and management’s adjusted diluted EPS guidance for FY2024 is $21.35 – $22.07. The forward adjusted diluted PE is, therefore, ~25.3 – ~26.1.

Using the currently available broker estimates, TMO’s forward-adjusted diluted PE levels are:

- FY2024 – 27 brokers – a forward-adjusted diluted PE of ~25.7 using a mean of $21.74 and low/high of $21.34 – $21.88.

- FY2025 – 27 brokers – a forward-adjusted diluted PE of ~23.3 using a mean of $23.96 and low/high of $22.33 – $24.40.

- FY2026 – 21 brokers – a forward-adjusted diluted PE of ~20.8 using a mean of $26.85 and low/high of $25.03 – $27.22.

I now exclude SBC in calculating a company’s FCF. TMO’s SBC for FY2024 is likely to be ~$0.3B. Rather than use management $6.5B – $7B of FY2024 FCF guidance, I will err on the side of caution and will use $6.5B to determine P/FCF.

Using management’s outlook of ~383 million shares for the full year average diluted share count, the FY2024 FCF/share should be ~$17. Divide the current ~$558 share price by ~$17 and we get a P/FCF of ~32.8.

Final Thoughts

TMO has multiple brands (eg. Thermo Scientific, PPD, Patheon, Applied Biosystems, etc). I encourage you to access the websites of these brands to see the magnitude of TMO’s product offering.

Having become a ‘one-stop shop’, TMO has become increasingly less sensitive to economic cycles; more of its revenue is related to essential activities of research laboratories versus capital budgets.

A large portion of TMO’s business mix is consumables and services (~82% of sales) and a large portion is recurring business.

A shift toward biopharma clients has also made TMO less susceptible to more volatile infrastructure and applied end markets, even in emerging-markets where the biopharma channel is experiencing rapid growth.

The current biopharma spending is somewhat constrained and no significant improvement is anticipated throughout 2025. I, however, envision improved business conditions in the coming years which is why I have exposure to TMO, Danaher, and Agilent.

I only hold 177 shares (52 shares and 125 shares in two different ‘Core’ accounts) in the FFJ Portfolio. It was, therefore, only my 28th largest holding when I completed my 2024 Mid Year FFJ Portfolio Review.

TMO’s share price can experience considerable volatility with a year; the current 52 Week Range is $437.26 – $627.88. I do intend to increase my exposure but think there will be an opportunity to acquire shares at a more favorable valuation.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long TMO, DHR, and A.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.