McDonald’s Corporation (MCD) released Q2 and YTD results on July 26, 2019.

I anticipate further improvements from its Growth Strategy which was launched in 2017 and am optimistic in its long-term growth prospects in China where there is ample opportunity to increase penetration in a country of 1.4 billion people.

Summary

- MCD’s top line has declined in recent years but this is the result of a strategic decision to reduce the number of company owned outlets and to increase the number of franchised outlets to ~95%.

- MCD intends to open more than 400 stores in China by the end of 2019 as part of its 5 year plan to nearly double its store count to 4,500 by 2022.

- The significant reduction in the number of shares outstanding in recent years is likely to continue as management works toward improving shareholder returns.

- MCD has taken advantage of the low interest rate environment in recent years and has increased the use of leverage as part of its strategy to improve shareholder returns.

Introduction

In my previous McDonald’s Corporation (MCD) article I indicated there is no dispute the major turnaround which commenced in 2015 was having a significant positive impact. My concern, however, was that shares were richly valued.

Unfortunately, MCD’s share price has subsequently risen in value with this increase partially fueled by current market conditions and by the increase in attractively priced long-term debt for the purpose of reducing share count.

In this article I look at MCD’s current valuation based on anticipated earnings for the remainder of the current fiscal year and provide my thoughts on MCD’s current valuation.

Business Overview

While the fast food industry is synonymous with low barriers to entry and intense competition, MCD is one of the few industry participants with a wide economic moat. Its competitive advantages include a widely recognized brand, a franchisee system aligned on driving unit-level productivity improvements, and meaningful economies of scale.

MCD is divided into the following segments based on the maturity and competitive position within different markets and this is how management reviews and evaluates operating performance.

- U.S. – the Company’s largest segment

- International Lead Markets – established markets including Australia, Canada, France, Germany, the U.K. and related markets

- High Growth Markets – markets the Company believes have relatively higher restaurant expansion and franchising potential including China, Italy, Korea, Poland, Russia, Spain, Switzerland, the Netherlands and related markets

- Foundational Markets & Corporate – the remaining markets in the McDonald’s system, most of which operate under a largely franchised model. Corporate activities are also reported within this segment.

MCD is primarily a franchisor, with ~93% of restaurants as at FYE2018 being owned and operated by independent franchisees. The restaurants it operates, and franchises, in more than 100 countries serve a locally-relevant menu of quality food and beverages. Franchised restaurants are owned and operated under either a conventional franchise or developmental license or affiliate.

MCD continually reviews its mix of Company-owned and franchised restaurants to help optimize overall performance. The long-term goal is to be ~95% franchised.

When the current CEO assumed his role in March 2015, reorganization was undertaken and MCD started operating under a new organizational structure beginning July 1, 2015.

The reasoning for restructuring was that the pace of change within MCD was being eclipsed by the pace of change outside the business. Market conditions and consumer dynamics were evolving and returning MCD to ‘growth’ mode required radical change.

By restructuring, MCD has been able to get closer to customers and speed up the process at the point of impact. Included in this restructuring was the decision to refranchise to drive growth and bringing greater insights at a local level; MCD refranchised more than 4,000 locations and the eliminated ~$0.5B in net annual selling, general, and administrative expenses.

MCD revamped its Growth Strategy in 2017 and details can be found here and in the 2017 CEO Letter to Shareholders.

As part of its Velocity Growth Plan (VGP), MCD is emphasizing the following “velocity growth accelerators”:

- Experience of the Future (EOTF);

- Digital;

- Delivery.

Further details on MCD’s VGP can be found on page 19 of 94 in the 2018 Form 10-K.

As part of its Growth Strategy, MCD sold the bulk of its China and Hong Kong business to The Carlyle Group LP (CG), a U.S. private equity firm, and Citic Limited, a Chinese state-owned investment group. By negotiating these deals MCD was able to cut costs because it no longer needs to operate those stores but it can still collect rent and royalty revenue.

In my May 2, 2018 article I wrote that investors who rely on stock screeners to identify investment opportunities could eliminate MCD as a potential investment if ‘sales growth past 5 years’ is one of the ‘screening’ metrics.

In that article I provided the 6 Year Summary of Selected Financial Data from FY2017’s 10K and I now provided the following information extracted from MCD’s FY2018 10-K.

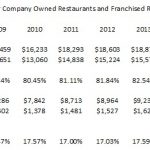

Looking closely at the 6-Year Summary of Selected Financial Data we see that MCD has been converting its company-owned outlets into franchised-owned outlets and a few thousand new franchised outlets have also been opened.

Company-owned stores certainly add top line revenue while franchised stores only add rent and franchise fees paid to MCD. Look closely at the data and you see that a key benefit to having a higher proportion of franchised outlets is that franchised restaurants’ occupancy expenses are ~17% – ~18.50% of revenue; this compares with ~80% – 85% for company operated restaurants. An attractive feature of the franchise concept is that MCD does not need to devote as much capital to growing or maintaining stores as franchise owners now carry some of that burden.

Looking at the benefits of MCD’s strategy to be ~95% franchised, we see that the decline in MCD’s top line over the past few years does not mean MCD’s business has stopped growing. Now, the focus can be placed on assessing MCD’s credit risk (2 notch decline in MCD’s long-term credit rating within the past 4 years and 5 notch decline since the turn of the century) and whether MCD’s valuation is acceptable relative to other potential investment opportunities.

Q2 and YTD2019 Results

MCD’s Q2 and YTD 2019 results reported July 26, 2019 can be found here.

The following is a partial list of Q2 and YTD achievements.

In Q2, global comparable sales increased 6.5% with each operating segment contributing meaningfully to MCD’s growth.

In the U.S., comp sales were up 5.7%, the highest comp sales increase since the launch of all day breakfast in Q4 2015. This marks 4 full years of quarterly comp sales growth.

The International Operated segment reported a 6.6% comp sales increase for the quarter. Each of the markets within the segment grew comp sales with strong results in the UK, France and Germany being key contributors to the segment’s growth; the UK marked its 53rd consecutive quarter of comp sales growth and increased market share versus competition.

Comp sales increased 7.9% in the International Developmental Licensed segment. Results across MCD’s 3 largest markets drove the strong sales performance with double-digit growth in Brazil, strong comps in Japan and positive performance in China. Accelerated new restaurant growth by MCD’s strategic partners, primarily in China, led the segment to grow system-wide sales by 10% for Q2.

MCD is also taking bold action on the ‘Delivery’ front to meet customers’ increasing demands for convenience and speed; MCD expects ‘Delivery’ to be a $4B global business in 2019. Across major markets, MCD has maintained double-digit ‘Delivery’ sales growth in restaurants offering ‘Delivery’ for more than 12 months.

‘Delivery’ now accounts for more than 10% of sales in restaurants in the UK and Spain where this service is offered.

In the U.S., ‘McDelivery’ with Uber Eats is now available in more than 9,000 restaurants, which is more than half of all MCD U.S. restaurants.

In Q2, MCD reported adjusted EPS of $2.05 which is a 7% increase when excluding impairment and other strategic charges from both the current and prior years.

Adjusted operating margin for the first half of FY2019 was 43.2%, an increase of 30 bps versus the first half of FY2018. As a result of franchising efforts over the past few years, the largest component of operating income is now franchise margin dollars; franchise margin dollars now represent nearly 85% of total restaurant margin dollars.

FY2019 Outlook

The targets set on the January 30, 2019 Q4 2018 Earnings Call remain the same. On that call, management indicated that in anticipation of being substantially complete with refranchising efforts, long-term average annual financial targets were set. These targets reflect:

- a 3% – 5% increase in system wide sales over the long-term;

- maintaining an operating margin in the mid-40% range;

- EPS growth in the high single-digits;

- a return on incremental invested capital in the mid-20% range.

Some headwinds in FY2019 around labor cost, EOTF-related depreciation in the U.S., commodities and foreign currency translation are anticipated and are expected to put pressure on EPS growth.

Management continues to be very confident about its long-term future in China. Although MCD does not release China’s performance metrics individually, senior executives have indicated that Chinese restaurants saw both sales and traffic growth in Q2.

The Chinese market is incredibly competitive but it is a huge market. With the emerging middle class there continues to be a greater number of people heading toward Western (quick-service) restaurants and there is also an increase in average spend.

Despite the well publicized deterioration in the US/China relationship, MCD is planning to open more than 400 stores in China by the end of 2019 as part of its 5 year plan to nearly double its store count to 4,500 by 2022.

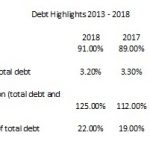

Debt

The following table provides a snapshot of the extent to which MCD’s debt has increased over the years.

MCD has certainly taken advantage of the low interest rate environment to raise long-term debt at extremely attractive interest rates.

The increase in total debt as a percent of total capitalization has helped MCD significantly reduce share count; I touch upon this in the ‘Share Repurchases’ section of this article.

Credit Ratings

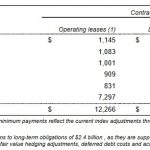

Looking at the following table extracted from MCD’s 2018 10-K we see that contractual cash outflows exceed contractual inflows in several future years.

We need to remember, however, that the contractual inflows are reflected as ‘minimum rent’. MCD will undoubtedly generate more than the minimum so I am not concerned that the currently projected outflows exceed the currently projected inflows. I also suspect that if the credit ratings agencies were concerned, MCD’s credit ratings would be lower than the current ratings.

Effective mid-November 2015 Standard & Poor’s has rated MCD’s long-term debt BBB+ with a stable outlook. This rating is the upper tier of the lower medium grade rating category.

Looking at MCD’s credit rating history assigned by Moody’s over the past couple of decades we see MCD’s senior unsecured long-term debt credit rating has dropped 5 notches from Aa2 (middle tier of the high grade rating category) to Baa1 (upper tier of the lower medium grade category).

There is no dispute that investors are now assuming a greater level of risk. I am, however, of the opinion that MCD’s business model and current strategy is far better than prior to the launch of the major turnaround in 2015.

Depending on your tolerance for risk you may not be satisfied with the currently assigned credit ratings which, by definition, mean:

‘MCD has ADEQUATE capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity to meet financial commitments.’

Personally, I fully expect MCD to meet its future obligations and am not contemplating on exiting my position, or not increasing it, because of risk.

Dividend, Dividend Yield, and Dividend Payout Ratio

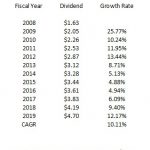

MCD’s dividend history can be found here and stock split history can be found here.

The 4th quarterly dividend payment of $1.16 will be distributed September 17th. I then envision the December 2019 dividend will be increased ~5.17% to $1.22 bringing the total 2019 dividend to $4.70.

Based on the current $214.48 stock price as at the close of business on August 2nd, MCD’s $4.70 annual dividend provides investors with a 2.2% dividend yield which is slightly lower than 2017 and 2018 levels of ~2.23% and 2.36% and well below 2009 – 2016 levels: 3.28%, 2.94%, 2.52%, 3.25%, 3.22%, 3.50%, 2.91%, and 2.97%.

MCD’s projected FY2019 annual dividend of $4.70 is ~59% of the $8.02 projected adjusted diluted FY2019 EPS and ~63% of the mid-point of the full year diluted EPS range of $7.40 – $7.50 I project. I view these payout ratios as acceptable.

Share Repurchases

Looking at page 22 of 94 of the 2018 10-K we see the weighted average number of diluted shares outstanding in 2018 was 785.6 million and on page 15 of 52 in the 2011 Annual Report we see this figure was 1,107.4 million shares. Fast forward to the Q2 2019 10-Q and this level has been reduced to 770.2 million shares outstanding. I expect MCD’s share count to continue to be reduced.

Valuation

In FY2017 and FY2018, MCD reported diluted EPS of $6.37 and $7.54. Looking at the year-end market price ($172.12 in 2017 and $177.57 in 2018) MCD’s diluted PE levels were ~27 and ~23.54.

On the basis of high single digit EPS growth guidance provided at the beginning of FY2019, a 7.5% growth from FY2018’s diluted EPS gives us diluted EPS of ~$8.11.

We now have Q2 2019 results which reflect YTD diluted EPS of $3.69 versus $3.62 in 2018. Achieving EPS of $4.42 in the second half of FY2019 to reach ~$8.11 seems to be a bit of a stretch. If we extrapolate results from the first half of the year and estimate a full year diluted EPS range of $7.40 – $7.50 versus ~$8.11, then using the current $214.48 share price we get a forward diluted EPS range of ~28.6 – ~29.

This range is higher than the 2009 – 2018 PE levels of 15.19, 16.76, 19.67, 16.46, 17.51, 18.44, 25.57, and 22.88 (~19 average).

Over 20 analysts are calling for FY2019 adjusted diluted EPS ranging from $7.90 – $8.10 with the current mean being ~$8.02. If we once again use the current $214.48 share price we get a forward adjusted diluted PE of ~26.74 which is higher than the average 5 year forward diluted PE of ~21.5.

In my opinion, a return to MCD’s attractive valuation levels evidenced prior to the introduction of MCD’s major turnaround efforts is optimistic. I think an adjusted diluted PE level of ~25 is more reasonable.

Using this PE level and a forward adjusted diluted EPS level of ~$8.02, I get a reasonable value as being ~$200 which would mean a ~6.8% pullback in MCD’s share price.

Final Thoughts

Although the deterioration in MCD’s long-term debt credit rating is not encouraging I am of the view that management will not let the company’s credit rating deteriorate to the extent where it really becomes a concern.

I like the strategic vision and am of the opinion that even if we enter an economic downturn, MCD will benefit because consumers will be looking for cheaper meal options. In addition, I think that even if the Chinese economy slows it will be an attractive growth market as MCD’s presence currently pales in comparison to the population of ~1.4B.

I encourage investors not to focus on the reduction in MCD’s top line because MCD purposely restructured its business to increase the degree of revenue generated from franchisees. The focus should be on MCD’s ability to maintain an operating margin in the mid-40% range and to continue to generate strong Free Cash Flow (typically in excess of $4B/year).

I fully intend to add to my MCD position but given current market conditions I am hoping that MCD’s share price will get caught in a downdraft. While MCD’s share price has ticked up slightly subsequent to the Fed’s announcement of a rate cut, I am cautiously optimistic MCD’s share price will pull back in the short-term if the US/China trade war escalates.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long MCD.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.