Low interest rates have fanned debt to insane levels. Consumers have not used the low interest rate environment to tackle their debt load.

Low Interest Rates Have Fanned Debt to Insane Levels in the US

In 2015, NerdWallet analyzed data from several sources, including the New York Federal Reserve and the U.S. Census Bureau. It subsequently commissioned an online survey, conducted by Harris Poll, of more than 2,000 adults to determine why Americans have so much debt.

The intended outcome of this study and the analysis of the results were to provide tips for consumers on how to:

- make room in their budgets;

- understand their debt so as to provide a frame of reference on how to pay down their outstanding debt;

- minimize/avoid interest charges.

NerdWallet discovered that the average U.S. household with debt carries $15,675 in credit card debt, $27,865 in auto loans, $48,591 in student loans and $132,158 in total debt excluding mortgages.

NerdWallet dug into the “why” and the psychology behind debt. It found multiple factors that contribute toward the increasing debt levels.

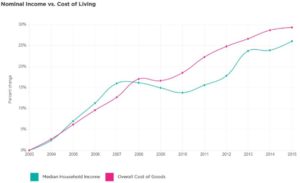

- The rise in the cost of living has outpaced income growth over the past 12 years. Median household income has grown 26% since 2003 but household expenses have grown to a far greater extent. Medical costs and food and beverage prices have grown by 51% and 37% respectively.

- Consumers vastly underestimate or under report how much debt they have. In 2013, actual lender-reported credit card debt was 155% greater than borrower-reported balances.

- The average household income is $75,591 and a total of $6,658 in interest expense is incurred annually. This is 8.8% of the total household income. I am willing to bet that gross income versus net income was obtained for the study. If such is the case, then the results are more alarming.

- Household income has grown by 26% in the past 12 years, but the cost of living has gone up 29% in that time period for a negative 3% variance.

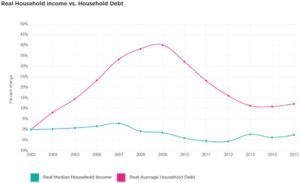

- Household debt has grown 15% faster than household income since 2003 after adjusting for inflation. While the negative variance between household income and household debt has improved from the negative 42% variance at the height of the 2009 recession, the fact there still is a negative variance is concerning.

- The cost of raising children is not insignificant. According to the U.S. Department of Agriculture, parents are projected to spend $245,340 to raise a child born in 2013, from birth to age 18. The statistics for Canada are likely similar.

- While self-employment can be a rewarding work status, it could mean incurring more debt than employee counterparts. Households run by self-employed individuals spend roughly 167% more in annual interest payments than households where the head of the household is employed.

Low Interest Rates Have Fanned Debt to Insane Levels in Canada

On December 7, 2016, Equifax Canada released its Q3 2016 National Consumer Credit Trends Report indicating the national 90 day+ delinquency rate and average debt held by Canadians increased in the 3rd quarter of 2016 relative to the same period in 2015.

Average debt increased by 3.6% to $22,081, while the delinquency rate increased from 1.05% to 1.14 %. This increase was largely driven by oil-producing provinces in Western Canada and Newfoundland.

Overall, there was no change in delinquency rates since Q2 2016.The highest delinquency rate increases were found in Alberta, Saskatchewan, and Newfoundland, which is not surprising given the dramatic downturn in the oil and gas sector.

A positive finding in this report it is that residents in Western Canada and Newfoundland, two provinces hit hard by the oil bust, are not piling on more debt. Secondly, Ontario and Quebec showed stability and consumers were displaying responsible repayment behaviour. On average, Canadians across the country were found to be managing their debt wisely, with the majority paying off their credit cards in full every month and few making only the minimum payments.

In my humble opinion, there should be cause for concern given that total consumer debt (excluding mortgages), remains on the rise. As of Q3 2016, Canadian consumers owe $1.702 TRILLION, compared to $1.666 TRILLION in Q2 2016 and $1.587 TRILLION in Q3 2015.

Equifax Canada also noted that the auto and installment loan sectors are showing significant increases in outstanding balances of 7.8% and 7.7% year-over-year. Our low interest rate environment is very likely a huge contributing factor to consumers’ willingness to take on additional debt to this magnitude.

I recognize we are in a low interest rate environment so most consumers may be able to meet their obligations. When, not if, interest rates start to creep up, we could be in a heap of trouble. Many Canadians have mortgages currently bearing a very low interest rate. If, in future, the interest rate environment is such that people need to renew their mortgages at slightly higher rates, there could be a spillover effect on the consumer debt side as consumers could be forced to redeploy their cash flow toward “priority” debt.

What is especially disconcerting to me about the huge increase in the auto and instalment loan sectors is that this is the type of debt incurred to generally acquire assets that depreciate in value.

I also find it alarming that Equifax indicates the majority of consumers are actually decreasing their debt, but those who are still increasing their debt load are adding larger amounts on average and by sufficient amounts to increase the total levels.

What to Do if You Are Part of These Unfortunate Statistics

If you have children, it certainly might be tempting to quickly address a debt problem by telling tell them to move out and to become self-sufficient (especially if they are teenagers). I don’t recommend this, however, since your teenagers are likely payback for all the things you did/did not do when you were a teenager!

Earning more income is a great idea but be careful. If you are going to earn more income you MUST change your spending habits because, generally, when income increases people start buying more thus increasing their debt load and debt service obligations. It gets worse as you move up the income scale since it becomes easier to obtain credit relative to people in lower income brackets.

To truly tackle your debt you must, first and foremost, ascertain just exactly how much debt you have, the interest rate and how much you are paying in interest annually to each creditor. Your chances of eliminating your debt diminishes dramatically if you do not know your starting point.

Analyze your spending habits and patterns. In the Tools section of this site you will find a CDN and a USD cash flow Excel file which will help you in this regard. There are 3 worksheets in each file:

- Historical Spend Analysis

- Projected Monthly Spend

- Actual Monthly Spend and Variance

Once you have completed entering the data in these worksheets you will be able to determine what areas of your overall spend are totally out of whack or may just require some tweaking.

- If you have expensive debt, try to renegotiate a reduction in the amount owing or a reduction in your interest rate. If a creditor is unwilling to negotiate, determine whether to can borrow elsewhere under more advantageous terms and use the proceeds to repay the expensive debt. A word of caution! You MUST discipline yourself not to revert to old habits otherwise you will end up with a debt consolidating loan and more of the debt you previously consolidated.

- If your net monthly deficit is sizable you will need to take much more drastic measures than simply eliminating a cup of coffee per day if you want to reduce your debt within a reasonable amount of time.

- If you have vices which have now become habits (excessive smoking, drinking, eating, gambling, shopping, etc.) stop right now. You may even require an intervention! Seriously. Quitting these things on your own is next to impossible.

- If you have depreciable assets which are financed and they are bleeding you dry, dispose of them and use whatever proceeds you generate from their sale to pay down debt.

- If you have too much house for what you can afford you may need to take the drastic measure of downsizing. So be it!

Vehicles are also the downfall of many. Many people own more car than they can afford and lease their vehicles. When the lease expires, they end up leasing a new vehicle. In essence, they have car lease payments that just seem to go on in perpetuity.

Final Thoughts

Some of my thoughts on debt reduction/elimination might be heresy but if you want to make some changes in your life, you’re going to have to make some changes in your life. Stress caused by a lack of money is not something you want in your life. There are enough other things in life to stress about.

Do what you need to do to get out of debt and don’t procrastinate!