With Goldman Sachs’ (GS) share price pullback following the release of Q4 and FY2021 earnings on January 18, 2022, investors might be wondering if it is an attractive investment.

I last covered GS in this October 15, 2021 post at which time GS was trading at ~$400. Based on my analysis, I concluded:

‘Given my opinion that a broad market pullback is not out of the realm of possibility, I do not intend to add to my GS position at the moment. I am, however, receptive to adding to my GS exposure if the share price experiences a pullback and more attractive opportunities do not present themselves.’

Let’s examine if GS is an attractive investment with shares currently trading at ~$347.50.

Goldman Sachs – Business Overview

GS provides a range of investment banking, investment management and securities services for clients which are delivered by teams working across multiple divisions.

A brief history of the company is found here and there is a fascinating 10-part documentary in which GS’s history is chronicled.

Investors unfamiliar with GS should read a comprehensive overview of the company in Part 1 of the 2020 10-K.

Since GS plays an integral role in financial markets, investors are encouraged to read the most current version of GS’s Resolution Plan. This Plan contains GS’s ongoing assessments of its recovery and resolution capabilities.

Goldman Sachs – Financials

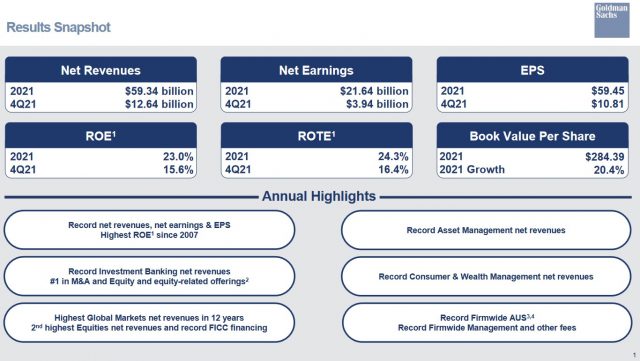

On January 18, 2022, GS released Q4 and FY2021 results. Details are found in Form 8-K and Earnings Presentation.

In this brief video, GS’s Global Head of Investor Relations shares the topics being discussed with investors, including the continued strength and diversity of the firm’s client franchise and progress in driving the durability of earnings.

Goldman Sachs – Credit Ratings

The credit ratings of interest to me are the senior unsecured long-term debt ratings for The Goldman Sachs Group, Inc. as this is the entity whose shares trade publicly.

- Moody’s assigns an A2 rating with a stable outlook.

- S&P Global assigns a BBB+ rating with a stable outlook.

- Fitch assigns an A rating with a stable outlook.

The Moody’s and Fitch ratings are the middle tier of the upper-medium grade investment-grade category. The rating assigned by S&P is two notches lower at the top tier of the lower-medium grade investment-grade category.

Moody’s and Fitch define GS as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

S&P Global defines GS as having an ADEQUATE capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Despite the variance in ratings, all 3 ratings are satisfactory for my purposes.

Goldman Sachs – Dividends and Share Repurchases

Dividend and Dividend Yield

GS does not maintain a dividend history on its website but this history is accessible here; the current quarterly dividend is $2/share.

Dividend income and dividend yield might be important to an investor depending on objectives and goals. In many cases, however, prioritizing these two metrics can lead to flawed investment decisions.

I think investors should focus on an investment’s TOTAL potential return. This explains why several of our holdings have a sub 1% dividend yield and a few distribute no dividend.

Share Repurchases

GS has 4 billion authorized shares of common stock and 200 million authorized shares of nonvoting common stock. The firm’s share repurchase program is intended to help maintain the appropriate level of common equity.

The share repurchase program is effected primarily through regular open-market purchases with the amounts and timing determined primarily by GS’s current and projected capital position, and capital deployment. These purchases may also be influenced by general market conditions and the prevailing price and trading volumes of the common stock.

GS suspended stock repurchases from Q1 2020 through to Q4 2020. Stock repurchases resumed in Q1 2021.

GS has been a prolific buyer of its issued and outstanding shares over the years with the FY2009 – FY2021 weighted average number of diluted shares outstanding (in millions) being 550.9, 585.3, 556.9, 516.1, 499.6, 473.2, 458.6, 435.1, 409.1, 390.2, 375.5, 360.3, and 355.8.

Goldman Sachs – Valuation

At the time of my July 28, 2021 post, GS was trading at ~$375 and in the first half of FY2021, it had generated $33.64 in diluted EPS. Management does not provide guidance so using the forward-adjusted diluted PE guidance available from the 2 discount brokerage trading platforms I use, I arrived at the following:

- FY2021: 22 brokers, mean estimate $53.14, low/high range $48.39 – $60. Valuation using mean estimate is ~7 and ~6.25 using the high end of the range.

- FY2022: 22 brokers, mean estimate $37.31, low/high range $32.98 – $41.50. Valuation using mean estimate is ~10 and ~9 using the high end of the range.

- FY2023: 11 brokers, mean estimate $39.53, low/high range $34.37 – $43.70. Valuation using mean estimate is ~9.5 and ~8.6 using the high end of the range.

When I wrote my October 15, 2021 post, GS had just released Q3 and YTD2021 results. Based on a ~$400 share price and adjusted diluted earnings estimates, GS’s adjusted diluted PE levels were:

- FY2021: 28 brokers, mean estimate $53.59, low/high range $48.66 – $58.63. Valuation using mean estimate is ~7.46 and ~6.82 using the high end of the range.

- FY2022: 28 brokers, mean estimate $38.04, low/high range $32.98 – $43.82. Valuation using mean estimate is ~10.5 and ~9.1 using the high end of the range.

- FY2023: 15 brokers, mean estimate $40.79, low/high range $34.37 – $46.05. Valuation using mean estimate is ~9.8 and ~8.7 using the high end of the range.

GS is to provide the investment community with more detail around its strategic objectives and targets in February. I anticipate a revision in earnings estimates following this February event. For current purposes, however, the forward adjusted diluted PE levels based on a ~$347.50 share price and adjusted diluted earnings estimates are:

- FY2022: 26 brokers, mean estimate $40.52, low/high range $34.58 – $45. Valuation using mean estimate is ~8.6.

- FY2023: 24 brokers, mean estimate $42.23, low/high range $37.65 – $48. Valuation using mean estimate is ~8.2.

Even if forecast earnings come in at the bottom end of the low/high ranges, GS’s forward valuation is attractive based on adjusted diluted EPS estimates.

GS’s current attractive valuation is such that I expect GS is/will be actively repurchasing shares. I would much prefer GS repurchase shares as opposed to distributing dividends. Buffett and Munger of Berkshire Hathaway also firmly believe buybacks, when done at the right prices and for the right reasons, are an effective way for executives to invest in their businesses and reward long-term shareholders.

Goldman Sachs – Final Thoughts

At the end of December 2021, Investment Account #8, one of the ‘Side’ accounts in the FFJ Portfolio, held 171 GS shares. The US cash available for deployment in this investment account has restricted my January 19, 2022 purchase to only 9 shares. With only 180 shares, GS is not a top 30 holding (refer to my January 7, 2022 Investment Holdings Review).

While I could free up funds by selling other holdings within this investment account, I typically just buy and hold. I do not actively trade nor do I reduce my exposure unless the underlying reason for investing in a company changes dramatically. Looking at Investment Account #8, I see no holdings in which I want to reduce my exposure.

GS’s share price presents a buying opportunity. I, however, have my sights set on other companies with the potential to generate long-term investment returns superior to those of GS.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long GS.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.