goeasy Ltd.’s (GSY.to) stock price has more than tripled since mid-March 2020. This has attracted considerable investor interest.

I think many investors may not have taken into consideration the degree of risk they are assuming by investing in a company which is in the business of providing loans to financially challenged individuals/small businesses.

Two major ratings agencies have rated the company’s long-term debt at the lowest level within the Non-investment grade – speculative category. As an equity investor, the degree of risk assumed is greater than that assumed by creditors. Equity investors should, therefore, be fully aware that an investment in this company is highly speculative. Investor beware!

Summary

- goeasy Ltd.’s share price has experienced a meteoric rise subsequent to mid-March 2020;

- Many investors who have taken a position in the company have likely focused on the potential return but have completely overlooked the risk aspect;

- ~80.5% of the company’s total assets are made up of loans to consumers/small businesses with very poor credit ratings;

- two major credit rating agencies rate goeasy’s long-term debt at the lowest tier of the Non-investment grade – speculative category;

- I do not have exposure to this company and, given my investment criteria, would never remotely consider investing in this company.

Introduction

In recent months I have come across various articles in which the writer has recommended Goeasy Ltd. (GSY.to) as a possible investment. These articles typically focus on the potential to generate attractive investment returns but very little attention (sometimes no attention) is given to the degree of risk an investor would be assuming by investing in this company.

While I do not dispute the company has rewarded investors who initiated an investment when we experienced a broad market meltdown in mid-March 2020, investors need to consider the degree of risk when making any investment.

Readers may recall that just prior to the Financial Crisis, lenders in the US were extending credit to borrowers of extremely high risk. A great number of mortgages and loans were sub-prime but by bundling huge pools of mortgages and loans, ratings agencies somehow came to the conclusion that the instruments being sold to investors warranted investment grade credit ratings.

When the Financial Crisis hit, investors holding this investment grade paper suddenly realized that if the underlying assets are of inferior quality, there is just no possible way that the financial instruments back-stopped by ‘garbage’ can be magically transformed into a high quality investment.

Fast forward ~10 years after the Financial Crisis and the same applies…if a company’s underlying assets are of inferior quality, the company is apt to be of inferior quality.

Unlike my other articles, I am dispensing with an analysis of the company’s dividend and valuation as my intent is to impress upon investors that the very nature of this business makes this a highly speculative investment.

Business Overview

GSY.to is in the business (Corporate Profile) of extending credit to individuals/small businesses of extremely poor credit quality through the following two business segments:

- easyfinancial, which offers high-interest loans to subprime clients;

- easyhome, which sells furniture and other durable goods on a rent-to-own basis.

If you’re wondering just how terrible of a credit risk GSY.to’s customer base happens to be…consider that interest rates on their loans range from 19.99% to 46.96%. At least this is what is posted on the company’s website. CBC Marketplace, however, conducted research a few years ago and came to the conclusion that the advertised rates were somewhat misleading and the cost to borrowers is truly greater than what is advertised (see here and here).

Regardless of whether the interest rate is what the company advertises or greater than advertised, the fact is the interest rates are well in excess of what a borrower with a decent credit rating would/should pay; the Prime Rate at the major Canadian financial institutions is currently 2.45% so even if a borrower pays 2% above this rate we are nowhere near what GSY.to charges its clients.

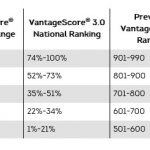

So why does GSY.to charge such high rates? Well, look at page 11 of 33 in the company’s quarterly financial statements as at September 30, 2020. On this page you will find tables which provide the gross consumer loans receivable split by the GSY.to’s risk ratings. Now look at the Median TransUnion Risk Score which is used to classify the loans as Low, Normal, and High risk. Looking at the creditor score grid found below, which was obtained from TransUnion’s wesbite, we see that GSY.to views a median credit score of 614 as being ‘low risk’. This credit score is terrible yet GSY.to categorizes loans extended to individuals with this credit score as being low risk? Yikes!

This is essentially a company which lends money to borrowers who, for whatever reason, have found themselves in a predicament where they can’t even manage their finances during a period of exteremely low interest rates. If these borrowers are unable to manage their finances properly in this low interest rate environment, what makes a GSY.to investor think the bulk of the underlying assets of the company are of reasonable quality?

This is essentially a company which lends money to borrowers who, for whatever reason, have found themselves in a predicament where they can’t even manage their finances during a period of exteremely low interest rates. If these borrowers are unable to manage their finances properly in this low interest rate environment, what makes a GSY.to investor think the bulk of the underlying assets of the company are of reasonable quality?

Looking at GSY.to’s September 30, 2020 financial statements, we see that ~80.5% of the company’s total assets consists of high risk Net Consumer Loans Receivable (page 2 of 33)! This is tantamount to having built a house on quicksand.

Another point to consider is that on November 27, 2019, GSY.to issued US$550.0 million of 5.375% senior unsecured Notes Payable with interest payable semi-annually on June 1 and December 1 of each year which commenced on June 1, 2020; the Notes Payable mature on December 1, 2024. I appreciate that the proceeds of the November 27, 2019 notes issuance were used to extinguish the previous US$475.0 million of 7.875% senior unsecured outstanding notes payable that would have matured on November 1, 2022 so at least GSY.to was able to reduce it borrowing cost. Contrast this interest rate, however, with $1B of 30 year money Hormel Foods was able to raise at 1.80% (see my recent Hormel article here). HRL raised far more money for a much longer timeframe and at a much lower rate. This goes to show just how inferior GSY.to’s credit quality is.

Credit Ratings

Fortunately, Moody’s and S&P Global are not making the same mistake in rating GSY.to’s debt as they made when they assigned investment grade ratings to some of the ‘junk’ that was being pedalled to investors prior to the Financial Crisis.

In the case of GSY.to, Moody’s has assigned a long-term debt rating of Ba3 since October 24, 2017 and S&P Global has assigned a BB- rating since August 3, 2017. Both ratings are comparable and are the lowest tier of the non-investment grade speculative category. Keep in mind that these are debt ratings so as an equity investor, you are assuming greater risk is higher. As an equity investor, you can view your investment in this company as ‘highly speculative’.

Final Thoughts

Warren Buffett, one of the greatest investors of all time, has stated on multiple occasions that ‘an investor should act as though he had a lifetime decision card with just twenty punches on it.’ This is a bit extreme so let’s suppose this number is expanded to 30 – 35. How anybody in their right mind could choose GSY.to to be one of these 30 – 35 punches is beyond me.

This company extends credit to financially challenged individuals/small businesses so it stands that an investment in GSY.to would be a speculative investment. If you enjoy speculating/gambling and have no qualms about investing in a lender that lends to borrowers who are one financial hiccup away from borrowing from payday lenders, loan sharks, or declaring personal bankruptcy then GSY.to might be a suitable investment for you. Personally, GSY.to will never be a punch on my ‘investment punch card’. I will stick with investing in high quality companies with competitive advantages.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not have exposure to GSY.to and fully intend never to invest in this company.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.