Attractive buying opportunities have been hard to find and with PPG’s stock price having retraced ~22% from its 52 week high I take a look at whether PPG is a worthwhile investment.

Summary

- The news coming from PPG in recent months has been less than positive.

- PPG released lower earnings guidance for Q3 and Q4 on October 8th (just before the recent market pullback).

- PPG’s ~18 forward PE (based on YTD results and guidance for the remainder of this current fiscal year) is well below its 5 year average PE of ~26.5.

- PPG’s low current valuation makes it a tempting investment but I have decided to pass on initiating a position and to wait for higher quality companies on my ‘watch list’ to become more attractively valued.

Introduction

In my recent ‘Embrace Market Pullbacks’ I suggested investors avoid panicking when markets encounter ‘speed bumps’ and to view pullbacks as opportunities to either add to existing positions or to initiate positions at more favorable valuations. Case in point….

….PPG Industries, Inc. (NYSE: PPG) and The Sherwin-Williams Company (NYSE: SHW).

I gave each company a cursory review a few months ago and found both to be somewhat expensive for my liking. I didn’t bother writing about either company and simply moved on although I did diarize to analyze PPG and SHW subsequent to the release of their Q3 results (October 18th and October 25th respectively).

My reasoning for moving up my PPG and SHW reviews, however, was prompted by last week’s market pullback. What I noticed was that PPG’s share price ($95.02) is ~22% below its 52 week high and that for SHW ($406.97) is ~15% below its 52 week high and neither stock price experienced at least a bit of a ‘snap back’ following the 2 day pullback.

In this article I take a quick look at PPG. My SHW review will follow in a subsequent article.

Overview

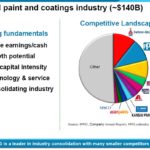

PPG, founded in 1883, manufactures and distributes a broad range of paints, coatings and specialty materials.

As you can see from the following image, the competitive landscape reflects a few large industry participants and over half of the ~$140B industry comprised of multiple smaller players.

Source: PPG – Investor Overview August 2018

It would not surprise me if PPG were to make some opportunistic acquisitions now that its strategic shift has been completed.

In September 2017, PPG culminated its multi-year strategic shift in its business portfolio. PPG is now comprised solely of the Performance Coatings and Industrial Coatings business segments.

Source: PPG – Investor Overview August 2018

Source: PPG – Investor Overview August 2018

Details regarding these two business segments can be found in Part 1 of the 2017 amended 10-K.

A detailed Investor Overview as recent as August 2018 can also be found here.

Accounting Shortcomings

Before proceeding further, readers should be aware that PPG had to restate its FY2017 financial results. The reasoning for this restatement is that on April 16, 2018, PPG’s Board received a report through its internal reporting system alleging violations of its accounting policies and procedures.

Long story short….

The Company’s Vice President and Controller at the time of these accounting irregularities is now the former PPG Vice President and Controller.

These irregularities are certainly concerning but investors should put the materiality of the amounts that where incorrectly reported in perspective. Have a look at variance between the original and restated line items reflected below. PPG is not a Sino-Forest, Enron, or Worldcom.

Net Sales

- Originally Reported Net Sales for 2017: $14.75B

- Restated Net Sales for 2017: $14.748B

- Originally Reported Net Sales for 2016: $14.27B

- Restated Net Sales for 2016: $14.27B

Net Income Attributable to PPG

- Originally Reported Net Income Attributable to PPG for 2017: $6.17/share

- Restated Net Income Attributable to PPG for 2017: $6.18/share

- Originally Reported Net Income Attributable to PPG for 2016: $3.28/share

- Restated Net Income Attributable to PPG for 2016: $3.27/share

Despite the immaterial variances, no investor likes to see restated financial statements. I strongly suspect that after having had to restate its FY2017 results, PPG is going to ensure future financial statements are ‘squeaky clean’.

Q3 2018 Update

As previously noted, PPG is scheduled to release its Q3 2018 results on October 18th. On October 8th, however, PPG issued an update on its upcoming Q3 results. In that Press Release, PPG indicated:

“We are disappointed with the third quarter earnings results. We continue to work proactively with our customers on higher selling prices to reflect the value of the products we sell and recover margins which have been negatively impacted by the raw material inflationary environment in all of our businesses. We will continue to aggressively manage our costs including accelerating restructuring activities wherever possible.”

- On the date of this Press Release, PPG closed at $109.65. At the open of the following business day (October 9th), PPG’s share price opened at ~$100.

- On October 10th and 11th, PPG’s stock price dropped further closing below $97 on the 11th.

- On October 12th, PPG continued to drift lower and as I compose this article the stock is trading at $95.09.

Credit Ratings

As a reasonably conservative investor I like to look at the credit aspect of the company in which I am prepared to invest. I certainly do not want to be investing in a company with high priced debt or with a substantial portion of the debt coming due within the short-term.

From the following schedule I see just under $1.3B in debt is due in 2019 – 2021. This debt has attractive rates of interest which likely will not be able to be duplicated if interest rates keep rising.

Having said this, PPG typically generates ~$1B in free cash flow on an annual basis so it should be able to easily retire this debt unless it decides to go on an acquisition spree.

Source: PPG – Amended 2017 10-K page 66 of 139

Moody’s assigned an A3 long-term credit rating to PPG’s long-term debt in March 2017 and S&P Global assigned an A- long-term credit rating in March 2014.

Neither entity revised their ratings subsequent to the revelation of improperly recorded expenses. This suggests to me that neither found the errors to be material.

Both Moody’s and S&P rate PPG at the lowest tier of the upper medium grade rating description but the ratings are of investment grade quality.

Goodwill and Identifiable Intangible Assets

Growth by acquisition can propel a company forward. At the same time, investors should be cognizant that overpaying for acquired companies can have negative implications. Nortel is a classic example of an acquisition strategy gone wrong!

I am not implying PPG is about to replicate what Nortel did. I am merely pointing out that in PPG’s May 14 2018 Information Session, growth by acquisition was a topic discussed extensively.

Source: PPG – 2018 Deep Dive, PPG Industrial Coatings Presentation

As at PPG’s most recent fiscal year end, Goodwill and Identifiable Intangible Assets amounted to $5.987B. This represented ~36.2% of PPG’s Total Assets.

At the end of Q2 (June 30th), PPG’s Goodwill and Identifiable Intangible Assets amounted to $5.906B. This represented ~35.1% of PPG’s Total Assets.

Readers interested in investing PPG would be wise to pay close attention to these line items if PPG becomes aggressive with acquisitions.

Source: PPG – Investor Overview August 2018

Source: PPG – Investor Overview August 2018

Valuation

In PPG’s October 8th Press Release, management indicated:

‘Q3 2018 reported earnings per diluted share from continuing operations are expected to be in the range of $1.47 – $1.51 and adjusted earnings per diluted share from continuing operations are expected to be in the range of $1.41 – $1.45.’

‘We currently expect Q4 earnings per diluted share to be in the range of $1.03 – $1.13, with the wide range primarily due to finalizing our full year tax rate.’

Using the $2.85 in EPS PPG generated for the first half of FY2018 and the low-end of the projected EPS ranges for Q3 and Q4, we arrive at an estimated FY2018 EPS of $5.29. As I compose this article, PPG is trading at $95.09 giving us a forward PE ratio of ~18.

If I use the mid-point of Q3 and Q4 earnings estimates and the first half of the year’s $2.85 EPS I arrive at projected EPS for FY2018 of $5.36. Using the current share price, we get a ~17.75 forward PE.

When I compare the forward PE ratios reflected above to PPG’s 5-year average PE ratio of ~26.5, PPG looks like a tempting investment.

Historical Performance

If we look at PPG’s earnings in recent years we see that results have been somewhat uneven.

Source: PPG – Investor Overview August 2018

Source: PPG – Investor Overview August 2018

I recognize PPG has undergone a business transformation over the last several years in which it has exited the Commodity Chemicals, Optical, and Glass businesses and is now focused solely on Coatings. These may have been the right strategic moves but I would prefer to monitor PPG’s performance to determine whether it can reverse the trend of underperforming the S&P 500 as it has over the past 6 years and to return to performance exhibited 10+ years ago.

Source: Tickertech

Dividend, Dividend Yield, Dividend Payout Ratio, Stock Splits, and Share Repurchases

PPG’s dividend and stock split history can be found here and here. Although PPG has increased its dividend for over 46 consecutive years, note how the frequency of PPG’s dividend increases is somewhat inconsistent; the number of months between dividend increases has fluctuated between 6 months and 15 months.

PPG’s quarterly dividend was increased to $0.48 from $0.45 with its recent September dividend payment. I view PPG’s dividend as safe in that PPG is expected to generate ~$5.36 in EPS this year and the annual dividend is $1.86 (two $0.45/quarter dividends and two$0.48/quarter dividends). This is a conservative ~34.7% dividend payout ratio.

On the basis of a current stock price of $95.09, the $1.86 dividend provides investors with a ~1.96% dividend yield. I am a Canadian resident so my yield on PPG would drop to ~1.67% since I would incur a 15% withholding tax; I no longer have contribution room in tax advantaged accounts.

I have no problem accepting a low dividend yield if I think a company’s stock is likely to produce attractive capital gains. I do not, however, view PPG as such a stock. PPG has underperformed the S&P500 for the past ~ 6 years and I am not optimistic there will be a change in this regard.

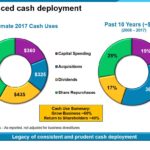

PPG has a balanced approach in the manner in which is deploys its cash. In addition to rewarding shareholders with dividend increases, PPG repurchases shares; PPG’s weighted average common shares outstanding have dropped from 331 million shares in FY2008 and FY2009 to 256.1 million in FY2017.

Source: PPG Investor Overview – August 2018

Final Thoughts

I have been struggling to identify attractively valued companies in which I can increase my position or initiate a position. As a result, I was cautiously optimistic that PPG might be an attractive addition to my holdings when I noticed its stock price had come off ~22% from its 52 week high.

After reviewing PPG, however, I have decided to pass on initiating a position. Although it might currently be attractively valued, I am of the opinion there are other companies on my ‘watch list’ with better growth prospects and will patiently wait for them to retrace to more attractive valuations.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently hold a position in PPG and have no intention of initiating a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.