Contents

Many investors have exposure to conventional investment categories. Investors seeking to diversify their investments, however, may want to invest in The Blackstone Group for exposure to alternative investments. Alternative investments can include:

- private equity or venture capital;

- hedge funds;

- managed futures;

- art and antiques;

- commodities;

- real estate; and

- derivatives contracts.

My investor profile is such that several of these alternative investments do not appeal to me. I do, however, want exposure to alternative investments which is why I have exposure to Blackstone Inc. (BX).

In my August 27, 2021 BX post, I disclose a new position in BX; on August 19 I acquired 500 shares @ ~$110/share within one of the 'Core' accounts in the FFJ Portfolio. Additional BX share purchases disclosed in subsequent posts are accessible in the Archives. My BX exposure is now 900 shares in a 'Core' account.

With the release of Q4 and FY2022 earnings on January 27, 2022, I now revisit BX.

Business Overview

I strongly encourage investors unfamiliar with BX to review the company's website and to review Part 1 of the FY2020 10-K.

Investments

The 'Our Businesses' section of BX's website has a menu of the areas in which BX invests.

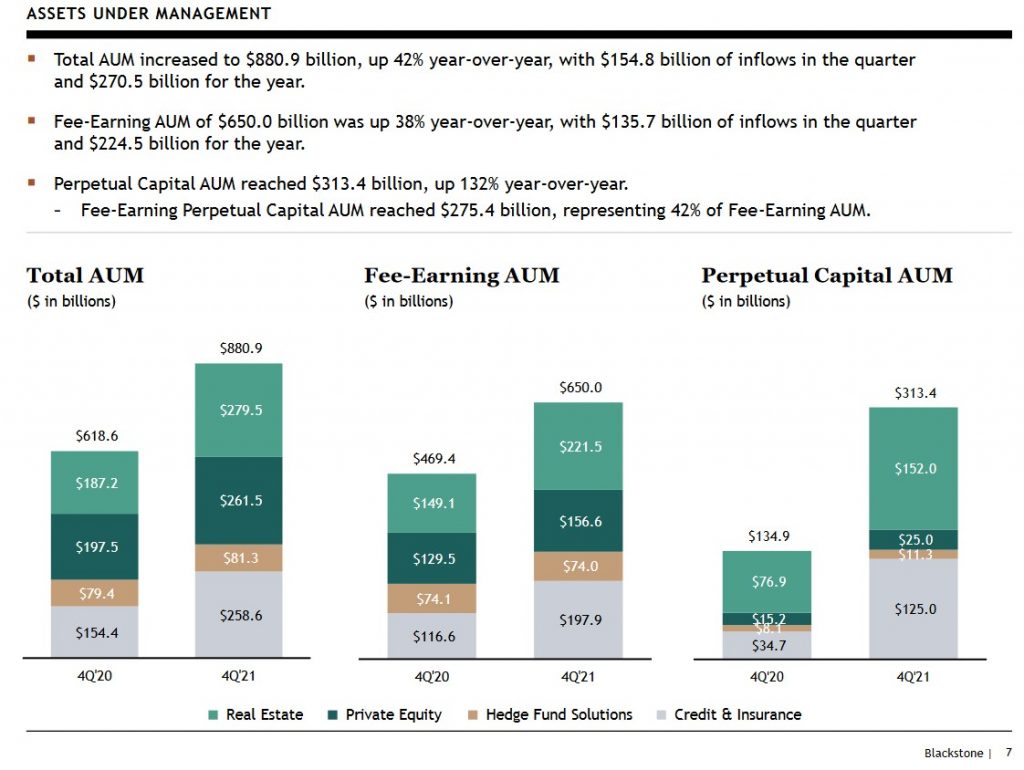

At the end of FY2021, BX had total Assets Under Management amounting to $880.9B. This is a 42% YoY increase.

The most current Form 13-F is as of the end of Q3 2021 (September 30, 2021) and it reflects the companies in which BX has invested.

Recent Transactions

BX is continually deploying funds raised from investors. Press Releases indicate BX's significant level of activity.

Financials

Q4 2021 and FY2021 Results

On January 27, 2022, BX released Q4 and FY2021 results. Additional information is found in the accompanying Supplemental Financial Data.

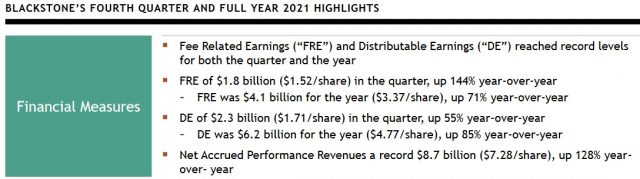

BX reported the strongest results in its history on virtually every metric. Distributable earnings (DE) rose 55% to $2.3B in Q4 and increased 85% to $6.2B for the year.

NOTE: DE is a meaningful metric as it increases comparability between periods and more accurately reflects earnings that are available for distribution to shareholders. It is a pre-tax non-GAAP financial measurement. It differs from Economic Net Income because it only includes the cash-generating portion of the performance and investment-related revenues and compensation expenses. Investors use DE as a proxy for cash earnings. However, DE includes some non-cash expenses – equity compensation from annual employee grants as well as depreciation.

Investment performance included >40% appreciation in BX's opportunistic real estate and corporate private equity funds for 2021.

Today, BX offers nearly 60 investment strategies, up from 35 five years ago.

Outlook

Given the strong pace of deployment across the firm, BX is now moving into a new flagship fundraising cycle. Over the next 18 months, it expects to have launched and to substantially complete fundraising for nearly all of the firm’s major drawdown strategies: 17 funds targeting ~$150B in aggregate, reflecting a 25% increase over the prior cycle.

BX's institutional perpetual funds should surpass $100B in FY2022. On the Q4 earnings call, management indicated there is significant investor demand for long-dated strategies that compound in value.

In infrastructure, BX has recently raised ~$7B bringing the strategy to $23B of perpetual capital after only 4 years. In addition, BX just recently announced a $3B investment in Invenergy, the largest private renewables company in North America.

On the insurance side, this business more than doubled in FY2021 to ~$60B with the closing of the AIG and Everlake mandates. AIG has committed an additional $42B and BX expects to find additional growth opportunities in this area on a capital-light basis.

In a nutshell, Q4 was BX's busiest ever, with $66B deployed and an additional $19B committed to pending transactions. The largest new commitments are in renewables, rental housing, logistics and content creation.

Credit Ratings

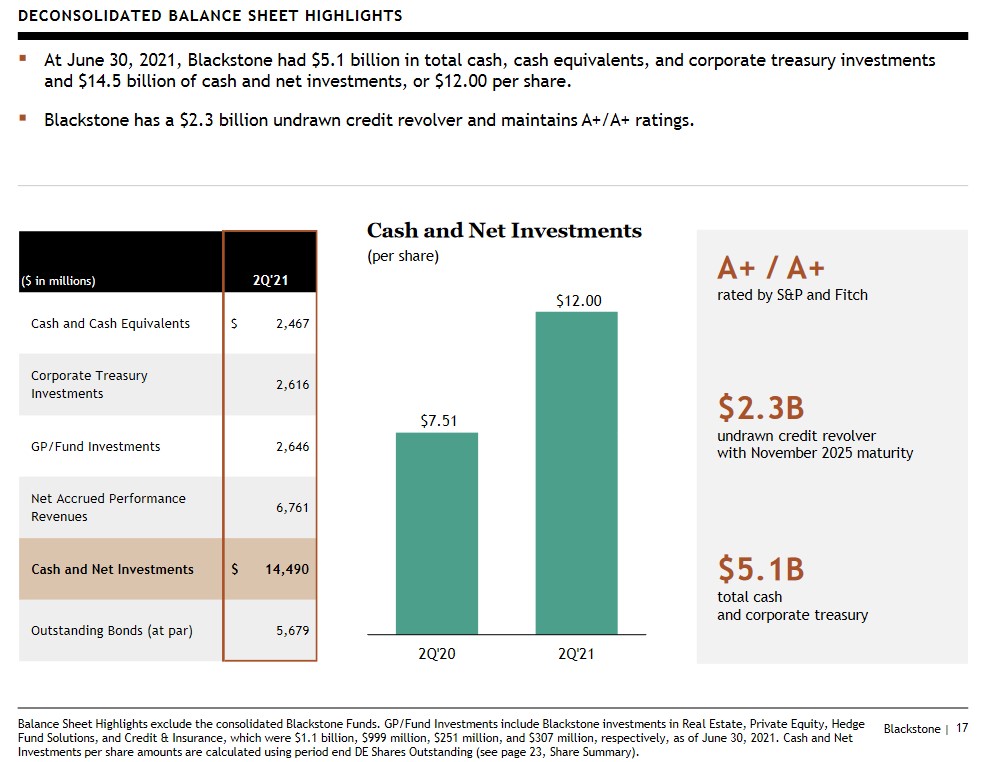

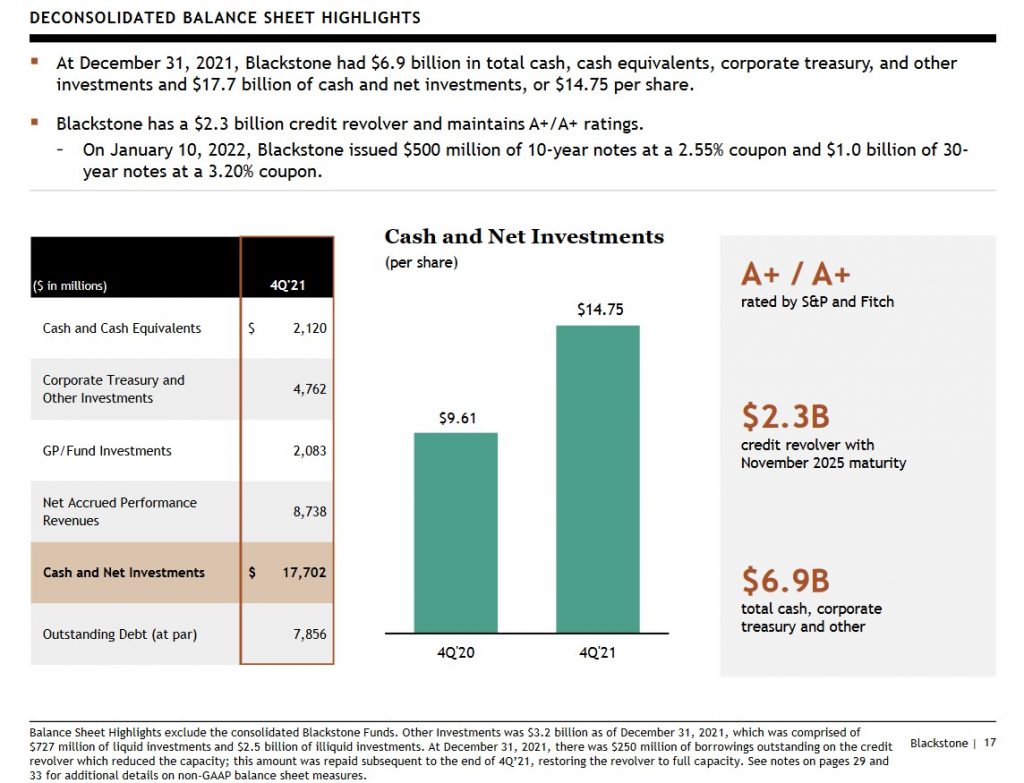

BX's senior unsecured domestic long-term debt ratings are in the top tier in the upper-medium-grade investment-grade tier and are unchanged from when I initiated my BX position.

- S&P Global assigns an A+ long-term unsecured debt credit rating with a stable outlook; and

- Fitch assigns an A+ long-term unsecured debt credit rating with a stable outlook;

These ratings define BX as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

The differences between the current consolidated Balance Sheet highlights and those from when I initiated my position are found below.

Source: BX - Q4 2021 Investor Presentation - January 27, 2022

Dividend and Dividend Yield

BX distributes a quarterly dividend but its dividend policy results in an unpredictable quarterly dividend. The November 8, 2021 $1.09 dividend, for example, has now been recently increased to $1.45 and is payable on February 14, 2022.

BX's dividend policy is based on DE:

'Our intention is to pay to holders of common stock a quarterly dividend representing approximately 85% of The Blackstone Group Inc.’s share of Distributable Earnings, subject to adjustment by amounts determined by our board of directors to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and funds, to comply with applicable law, any of our debt instruments or other agreements, or to provide for future cash requirements such as tax-related payments, clawback obligations and dividends to shareholders for any ensuing quarter. The dividend amount could also be adjusted upward in any one quarter.'

I think BX's dividend should bear little weight in deciding whether to invest in the company. Capital gains are likely to be a much more important factor in the long-term increase in the value of BX shares.

Despite the Q4 repurchase of 4.2 million common shares and 10.3 million common shares in FY2021, BX's diluted weighted-average shares of Class A common stock outstanding rose in FY2021.

In FY2012 - FY2021 (in millions of shares), BX reported 539, 591, 613, 1,188, 1,195, 666, 1,207, 676, 697, and 720.

Investors must also factor into account that BX employees receive Participating Partnership Units. The quarterly outstanding units in the Q4 2019 - Q4 2021 timeframe are: 515,973,657, 507,101,000, 504,912,855, 500,054,874, 496,060,455, 490,716,529, 487,276,882, 483,553,949, and 468,446,388.

I have no qualms about the increase in the number of outstanding shares as long as the underlying value of each share appreciates over the long term.

Valuation

I typically look at diluted EPS, adjusted diluted EPS, and free cash flow metrics to value most of the companies I analyze. These metrics, however, do not accurately reflect BX's performance.

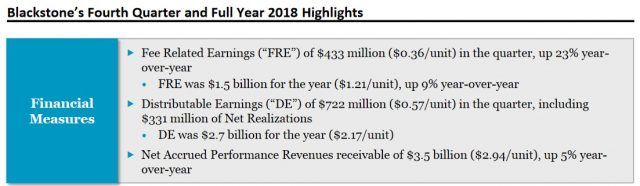

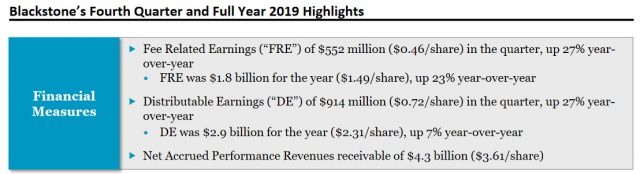

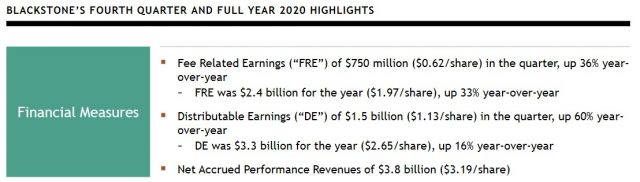

BX uses Distributable Earnings (DE) and Fee Related Earnings (FRE) to more accurately measure its performance; these, and other terms, are defined at the end of the Q4 2021 Earnings Presentation and within the FY2020 10-K.

The very manner in which BX operates makes it virtually impossible to estimate future DE and FRE. Furthermore, BX does not provide guidance.

The reason BX is not easy to value is that it raises large pools of capital from clients for deployment thus resulting in multiple multi-billion-dollar acquisitions annually. Because it continually makes sizable investment transactions (acquisitions or divestitures) earnings estimates can quickly become outdated.

Some of the acquired assets are meant to be perpetual holdings. In other cases, BX uses its expertise to improve the performance of the companies in which it invests with the intent of monetizing these assets as part of its capital recycling programs. It is not, therefore, unusual to see wide swings in YoY GAAP results.

Looking at DE and FRE results extracted from the Q4 and FYE 2017 - FY2021 Earnings Presentations, however, we can see that BX generates impressive results.

Final Thoughts

At BX's 2018 Investor Day, management shared its vision of reaching $1T of Assets Under Management in 8 years. It is now poised to reach this level in 2022. In addition, it has nearly tripled annual FRE and doubled DE after the 2018 Investor Day.

Interestingly, BX's profit margins have continued to expand and today are 3 times higher than the median of the largest 100 U.S. public companies.

Investor concerns around the impact of inflation and the prospect of rising interest rates might make investors wonder about BX's ability to continue to raise capital. BX, however, is well-balanced and the careful design of the portfolio should enable it to navigate the current environment.

For example, BX's $280B real estate business generated nearly half of BX's earnings in FY2021. It has over 70% of the equity portfolio in logistics, rental housing and life sciences offices. Leases in this portfolio are shorter duration thus giving BX the ability to reprice as inflation increases. In the US, BX is seeing rents in these sectors grow at 2 - 3 times the rate of inflation. Furthermore, as the cost of new construction rises with inflation, this should benefit the value of existing holdings.

The vast majority of its investments in corporate credit are in floating rate debt so BX stands to benefit from higher interest rates in response to inflation. This helps protect capital and provides a better return as base rates increase.

Although higher rates can be a headwind for liquid markets, BX has $136B of dry capital across the firm. This gives it the ability to move quickly to invest when pricing becomes more favourable.

On the fundraising front, institutional Limited Partnerships are increasing their allocations to alternative investments and capital is being concentrated with fewer managers. BX also stands to benefit from retail investors who have accumulated $2.8T of excess savings since the start of the pandemic.

When I completed my January 2022 Investment Holdings Review, BX was my 22nd largest holding; I had no exposure to BX before August 2021.

My rationale for investing in BX remains unchanged from my August 27, 2021 post. I continue to suggest an investor invest in BX for exposure to alternative investments.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long BX.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.