Contents

Summary

Summary

- GE released Q3 result on October 20th which fell far short of expectations.

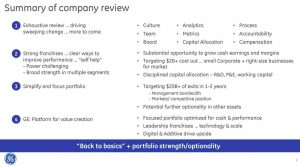

- The new Chairman and CEO and his senior leadership team are undertaking a rigorous analysis of all areas of the business in order to make major an urgent changes.

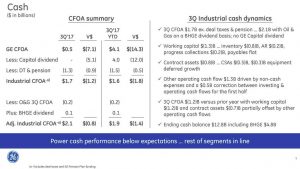

- GE’s new cash flow from operating activities projection is $7B, a steep drop from the company's previous view of $12B-$14B.

- The ability to service the existing dividend, pensions, and capital investments is in jeopardy. GE has previously cut its dividend and another dividend cut is not beyond the total realm of possibility.

- I am selling our GE shares as part of our Registered Retirement Savings Plan meltdown strategy.

Introduction

General Electric (NYSE: GE) released its Q3 results October 20, 2017. Results were less than spectacular. My short and mid-term prognosis suggests this is an opportune time to liquidate our GE holdings as part of our Registered Retirement Savings Plan (RRSP) meltdown strategy.

Q3 2017 Earnings Release

GE’s historical performance over the last several years has been less than stellar. Nevertheless it is disconcerting when John Flannery, GE’s new Chairman and CEO, begins a conference call by saying:

“While the company has many areas of strength, it is also clear from our current results that we need to make some major changes, with urgency and a depth of purpose. Our results are unacceptable to say the least.”

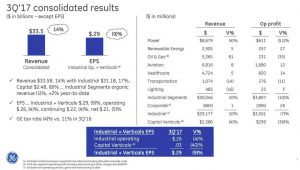

Mr. Flannery’s remarks during the October 20, 2017 earnings call are certainly worth reading together with the presentation of which a few pertinent slides are provided.

Source: GE Q3 2017 Presentation

Source: GE Q3 2017 Presentation

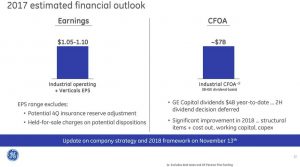

While GE’s revenue rose 11% YoY to $33.47B, it earned $0.29/share while analysts were anticipating $0.49/share on revenue of $32.5B. GE now expects to earn $1.05 - $1.10/share versus previous guidance of $1.60 - $1.70/share and the $1.53/share consensus estimate. The magnitude of the variance from analysts’ projections is, in my opinion, somewhat alarming for a company which ranks amongst the largest of companies in the S&P500 from a market capitalization perspective.

GE's performance was heavily weighed down by its power business. Profits declined 51% to $0.611B from $1.3B the same time last year. The oil and gas business also posted less than stellar results with a $0.036B loss versus a $0.353B profit a year ago.

Dividend

Operating and free cash flow has certainly been an issue in recent years and the concern about GE’s ability to fund its dividend, pensions and capital investments is currently in question. GE’s annual dividend alone is ~$9B and the new cash flow from operating activities (CFOA) projection is now $7B, a steep drop from the company's previous view of $12B-$14B.

GE slashed its quarterly dividend from $0.31 to $0.10 in 2009. Clearly the quarterly dividend is not sacrosanct.

I strongly suspect that as the exhaustive review of all aspects of GE continues, a laundry list of changes is being compiled. A dividend cut is likely on this list and investors would be wise not to be enticed by the current ~4% dividend yield.

Typically, when a new CEO takes the helm, a thorough analysis of the business is conducted and any changes deemed essential are made within the first year of his/her tenure; a company’s performance in year 1 of a new CEO’s tenure is often associated with the prior CEO. I, therefore, am of the opinion that anything and everything that needs to be changed/rectified will be identified as early as possible subsequent to Flannery’s assumption of the helm.

Flannery and his senior leadership team have already identified $20B+ of assets that will be exited within 1 -2 years. A rigorous analysis of other areas of the business is currently underway and the divestiture of other assets is a real possibility.

In addition to these divestitures, investors should expect to be presented with a list of dramatic planned changes come the November 13, 2017.

Option Strategy

I am encouraged by Flannery’s “no nonsense” approach. I mulled the possibility of patiently bidding my time to see how GE’s restructuring turns out. I am a long-term investor and very rarely sell an investment; this approach has served me well for the most part.

Given my investment style I was patient with GE when it cut its dividend in 2009 and had to seek financial assistance form Berkshire Hathaway.

This time around I contemplated writing covered calls. I looked at in and out of the money March 2018 calls around the current stock price of $23.82 (as at the close of business October 20). I just did not see enough of a premium to make it worth my while to enter into an option strategy.

My Plan of Action

I have no imminent desire to reinvest in GE. It has literally been the worst performing holding of all the stocks my wife and I own. A list of all the companies in which we hold shares can be found here.

The sudden same day drop and bounce back in GE’s stock price the day of its Q3 earnings release suggests to me that GE’s stock price will experience some volatility over the next little while.

I suspect GE’s stock price will drop come the November 13th investor update. Given that I must start to extract money from my RRSP in 2018 as part of my RRSP meltdown strategy, I have decided to liquidate my GE shares and park my cash in a money market ETF until 2018.

Final Thoughts

The vast majority of our holdings have experienced double/triple digit growth. GE, however, is an exception even when I take into consideration:

- the automatic reinvestment of all dividends (even during the 2009 – 2011 timeframe);

- additional share purchases I made at the height of the Financial Crisis;

- some option premium income I generated over time by writing covered calls.

In fact, if I take into consideration the time value of money I am slightly underwater.

I am cautiously optimistic the new Chairman and CEO will not spare the rod and will make the dramatic changes which should have been made under Immelt’s (former Chairman and CEO) watch. I, however, have other “life” priorities. Given these priorities, the recent earnings announcement has given me enough cause for concern that I am selling my shares as part of my RRSP meltdown strategy.

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long GE but will be selling my shares within 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.