Contents

Summary

Summary

- This Emerson Electric stock analysis is based on Q1 2017 results and outlook for remainder of fiscal 2017 which were released February 7, 2017.

- EMR is currently undergoing a major transformation of its business to reverse the deterioration in its financial performance.

- Markets reacted positively to EMR’s Q1 2017 results.

- I think EMR is overpriced by $18 - $20/share and that investors are not being adequately compensated for the risks involved.

- On February 7, 2017, EMR’s Board declared the regular quareterly cash dividend of $0.48/share payable March 10, 2017. This is the 2nd consecutive quarter of EMR’s minuscule $0.005/share dividend increase.

Introduction

According to the US National Bureau of Economic Research (the official arbiter of US recessions) the Great Recession in the US lasted 19 months (December 2007 - June 2009). Our initial purchase of several hundred shares of Emerson Electric Co. (NYSE: EMR) was at $32.1499 in early July 2009 when share prices were, for the most part, in the doldrums.

We have never sold these shares and have, on a couple of occasions, acquired additional shares subsequent to our original purchase.

In 2015’s Annual Report, the theme was “Transforming to Better Serve a Connected World”. The company indicated FY2015 was marked by the challenges of an increasingly complex and unpredictable global marketplace. It was a year in which EMR confronted the trend of declining sales and earnings by undertaking several initiatives to strengthen its core businesses and to drive near- and long-term value for its customers and shareholders.

This involved the strategic repositioning of the company such that it would have a focused portfolio in stronger growth-end markets. The decision was made to focus on two core business platforms, Automation Solutions and Commercial & Residential Solutions.

In 2016, the theme in management’s Letter to Shareholders was “Rising to the New Challenge”. In this letter, investors were informed that EMR had made significant strides to transform itself into a more focused enterprise.

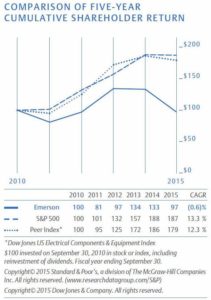

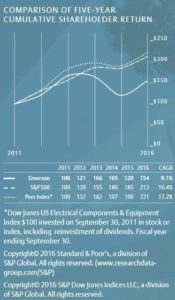

The following charts extracted from EMR’s 2014 - 2016 Annual Report and/or Letter to Shareholders compares EMR’s 5 year stock performance relative to its peer group. Results are not pretty.

Given that EMR released its Q1 2017 earnings February 7, 2017, it is an opportune time for me to review its transformation progress. In this post I provide:

- a few metrics from the year in which we acquired our original EMR shares (FY 2009) vs. FY 2016.

- a review of Q1 2017 results and EMR’s forecast for the remainder of fiscal 2017.

- my estimated value for EMR and whether you should consider it as a buy/sell/hold.

- a possible option strategy.

- my plans regarding our current EMR shares.

Industry Overview

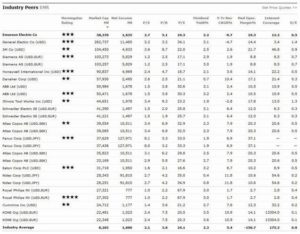

EMR’s businesses operate in end markets that are highly competitive. Some of its competitors have substantially greater sales, assets and financial resources than EMR. In addition, it also competes with many smaller companies. As a result of having to compete in a highly fragmented industry, EMR must deliver solutions to customers by manufacturing and selling high-quality products at competitive prices.

I provide the following lists of EMR’s peers for reference purposes. As you can see, there is considerable latitude when it comes to determining EMR’s peer group.

Business Overview

EMR was incorporated in Missouri in 1890. Over the course of roughly 127 years of being in business, it has evolved through internal growth and strategic acquisitions and divestitures.

On December 1, 2016, EMR announced that it had completed the sale of its Network Power business to Platinum Equity and a group of co-investors. Emerson received proceeds of $4B and retained a subordinated interest in the business.

On February 1, 2017, EMR announced that it had closed the sale of its Leroy-Somer and Control Techniques businesses to Nidec Corporation for a purchase price of $1.2B.

In addition, part of this strategic transformation includes the acquisition of strong and innovative businesses to strengthen the core of its two realigned business platforms. This is part of EMR’s goal to rebuild sales and earnings momentum to return to sales levels in excess of $20B/year.

On August 18, 2016, EMR entered into an agreement to acquire Pentair’s Valves & Controls business for approximately $3.15B which will complement Process Management’s final control business. Analysts were not bullish on this acquisition announcement and viewed it as adding additional risk to EMR’s earnings over the next several years. For the most part, analysts viewed this “strategic deal” as being executed at the wrong time of the business cycle since this business had suffered from a slump in the global process-automation market that could result in further order declines.

On October 3, 2016, EMR announced it had agreed to acquire UK-based Permasense Limited, a leading provider of non-intrusive corrosion monitoring technologies for the offshore and onshore oil production, refining, chemical, power, pipelines, metals and mining and other industries.

On November 8, 2016, EMR extended its presence in advanced flow measurement and control technologies with the acquisition of the Blending & Transfer Systems business of FMC Technologies, a leading provider of systems for lubricant, grease, fuel and chemical blending applications within the refining and chemical industries.

FY 2009 vs. FY2016 results comparison

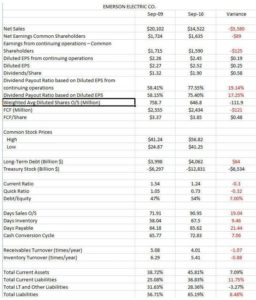

As an EMR shareholder I am pleased to see the track record of annual dividend increases has been maintained during these last few challenging years. I am also pleased to see that the weighted average number of diluted shares outstanding has been reduced significantly. What does not please me, however, is the deterioration of the company’s financial position at the expense of the repurchase of outstanding shares and the dividend increases.

I draw to your attention the following table I compiled which reflects some of EMR’s metrics from FY 2009, the year in which we made our initial EMR investment, and the FY 2016 results. As you can see, a number of metrics (denoted in red) have deteriorated quite dramatically. If I were a vendor to EMR, I certainly would not be pleased if EMR were taking an extra 20+ days to pay its bills.

In addition, the liquidity and debt ratios have deteriorated substantially.

For all dividend investors who like EMR’s track record of annual dividend increases, note how the dividend payout ratio has risen substantially. Now you can see why the recent annual dividend increases have been so insignificant.

Q1 2017 Results

On February 7, 2017 EMR released its Q1 earnings. A copy of the slides presented during its Q1 2017 conference call can be found here.

- Q1 sales and profit exceeded expectations with net sales of $3.2B, down 4%, or 3% on an underlying basis.

- EPS from continuing operations increased 22% to $0.56. This included an income tax benefit of $0.07/share.

- Operating cash flow from continuing operations increased 6% versus Q1 2016

- Pretax margin of 14.4% exceeded Q1 2016 by 140 bps.

- EBIT margin of 15.8% increased 140 bps primarily due to savings from restructuring activities.

- Operating cash flow from continuing operations of $410MM increased 6% versus Q1 2016. Including the impact of discontinued operations (Network Power, Leroy-Somer and Control Techniques), EPS was $0.48, down 9% and operating cash flow was $238MM, down 51%.

Outlook for Remainder of Fiscal 2017

- Management has raised its outlook for 2017 with full year net sales expected to be down 1 – 3% and underlying sales flat to down 2% excluding unfavorable currency translation of approximately 1%.

- EPS from continuing operations is now expected to be $2.47 - $2.62, including the $0.07 income tax benefit in Q1. This is an increase from the previous forecast of $2.35 - $2.50.

- Automation Solutions net sales are now expected to be down 5 – 7%, with underlying sales down 3 – 5% excluding unfavorable currency of approximately 2%.

- Commercial & Residential Solutions net and underlying sales are now expected to be up 3 – 5%. This outlook continues to exclude any impact related to the pending acquisition of the Pentair Valves & Controls business.

- Significant challenges are expected to persist throughout 2017 but management is optimistic the improving market conditions and broad-based increase in demand within many of its global served markets will help Q3 and Q4 performance.

Valuation

EMR realized a few short years ago that if it expected different results by continuing to do the same thing over and over again, it would be really behind the 8 ball in the not too distant future. As a result, it undertook a major transformation through the divestiture of various businesses and the expansion of the businesses it decided to retain/expand.

As a result of the turmoil I expected EMR’s stock price to drop. While it has dipped from its late 2013/early 2014 highs, I still view EMR as being considerably overpriced.

As I compose this post, EMR is currently trading at $62.50 and a PE of 25.36 according to Google Finance. Based on management’s revised projection of EPS from continuing operations in the range of $2.47 - $2.62, we get a PE range of 23.86 – 25.31.

I generally include earnings estimates based on input from multiple brokers and do so below. It appears earnings estimates have not yet been updated to reflect management’s revised estimated adjusted EPS range. I will, however, use management’s revised estimates for my valuation calculation purposes.

I view this revised 23.86 – 25.31 PE range as still being far too high for EMR considering the monumental task it has of turning around its business and the challenging market conditions. Given all the uncertainty surrounding EMR as it transforms its business and because of the macroeconomic headwinds it faces, I view a PE of 17ish as being more reasonable. If I use a projected EPS from continuing operations projection of $2.47 - $2.62, I get a price range of $42 - $44.50. This means I think EMR is overpriced by roughly $18 - $20.

I recognize EMR is a favorite of many investors who have a slant toward companies with a track record of annual dividend increases. It is one of less than 20 companies with a track record of increasing its dividend annually for a minimum of 50 consecutive years thus placing it an elite group of companies known as Dividend Kings.

On February 7, 2017, EMR’s Board declared the regular quarterly cash dividend of $0.48/share payable March 10, 2017, to stockholders of record February 17, 2017. This $1.92 annual dividend represents a 3.07% dividend yield on EMR’s current price of $62.50. This, in my opinion, is an extremely low yield for a company that is going through such a dramatic change in its business and where there is an element of uncertainty as to how successful the Pentair acquisition will be once the deal closes.

While some readers might think I am delusional to think that EMR should have a dividend yield in the 4.3% - 4.6% range (calculated using the $1.92 annual dividend and a price range of $42 - $44.50), I think this is more appropriate than the current dividend yield.

While EMR’s Board recognizes just how delicate EMR’s situation is, it clearly takes the company’s dividend track record very seriously; it increased EMR’s quarterly dividend by half a penny.

Option Strategy

I certainly do not recommend acquiring EMR shares at current levels. As a result, my Option Strategy in this post will be geared toward readers who currently own EMR shares, want to continue to own EMR shares, but who desire to be compensated a bit more for the risk of retaining ownership.

You could write a $67.50 call expiring September 15, 2017 and receive roughly $1.50/share minus commission. I don’t think EMR will climb to that level by September 15, 2017 so the options you sell would expire worthless; you would keep your shares and the options premium you collected.

If EMR does rise above that level and you do not want to get called away, you could close your position and write new options at a higher strike price and further out on the calendar.

Emerson Electric Stock Analysis - Final Thoughts

I hope I did not come across as being critical of management. I recognize they have a Herculean task of trying to change the company’s strategic direction and this is not something that can be achieved within one year. Secondly, I have never managed a multi-billion dollar company so who am I to be critical of EMR’s management.

I am merely of the opinion that EMR is vastly overpriced at this stage. I think Mr. Market is already of the opinion that EMR’s problems are over when it values the company at a PE range of 23.86 – 25.31 on the basis of management’s revised EPS from continuing operations projection of $2.47 - $2.62.

I also think many investors look at EMR’s Dividend King track record and are prepared to pay up for the consistency of increasing dividends. I certainly hope, however, that investors who purchase EMR on the basis of its dividend track record recognize that the annual dividend increases are minuscule.

I would not be purchasing EMR at current levels. A range of $42 - $44.50 seems to be more appropriate from my perspective.

While we own several hundred EMR shares at an average cost of $34.6936 and you could rightfully question why we would not sell our shares given that I think EMR is vastly overpriced, I am not selling because I am a long-term investor. I think management will fix EMR within the next 2 – 3 years and I am willing to give management time to do what they said they would do. I just sincerely hope EMR “Rises to the New Challenge”.

Disclaimer: I have no knowledge of your circumstances and am not providing individualized advice or recommendations. I encourage you to conduct your own research and due diligence and to consult your financial advisor about your situation.

Disclosure: I am long EMR.

I wrote this article myself and it expresses my opinions. I am not receiving compensation for it and have no business relationship with any company mentioned.