Contents

Cisco Systems, Inc. (CSCO) is a dominant supplier of switches, routers, firewalls, and complementary networking products. Its products are mission critical for network performance, stability, and security.

It released its Q4 and FY2019 results and provided Q1 2020 guidance following the August 14, 2019 market close.

Long-term investors would be wise to closely look CSCO's current valuation.

Summary

- CSCO’s share price plummeted ~8.6%, the most in ~6 years, after reporting Q4 and FY2019 results and lackluster Q1 guidance.

- The U.S.-China trade dispute and a slowing global economy are leading customers to delay updates of their computer networks.

- Chinese state-owned enterprises are not permitting CSCO to bid for business.

- China represents ~3% of CSCO’s business.

- CSCO has generated $12B+/year in Free Cash Flow in recent years.

- On the August 15th Q4 Earnings Call management indicated the plan is to balance share buybacks and dividends to be at least 50% of free cash flow.

- CSCO is currently attractively valued and offers a ~3% dividend yield.

Introduction

On May 21st I wrote a Cisco Systems, Inc. (CSCO) article in which I expressed an opinion that shares were richly valued.

Fast forward ~3 months and CSCO has released Q4 and FY2019 results following the August 14th market close. Results and guidance have not meet investor expectations and CSCO’s share price has retraced ~8.6% to close at $46.25 on August 15th.

Does the pullback in CSCO’s share price present a buying opportunity? Let’s have a look.

Big Picture

We are certainly living in interesting times and trying to predict how CSCO will perform in the short-term is a crapshoot. From a long-term perspective, however, CSCO’s technology is fundamentally redefining IT architectures to help customers manage the complexities of a multi-cloud world and to transform for the future.

On the Q4 2019 analyst call, CSCO’s Chairman and CEO covered the following recent highlights across CSCO’s portfolio.

On the infrastructure platform front, CSCO has spent the last couple of years re-architecting its entire networking portfolio to deliver new capabilities through its automation platform.

At Cisco Live, for example, CSCO launched several new technology innovations across networking domains to more effectively secure and manage users and applications across the entire enterprise from campus networks and wide area networks, to data centers and the IoT Edge.

It has added several artificial intelligence (AI) and machine learning (ML) software capabilities to improve network management through its automation platform.

In Q4, CSCO delivered data center network insights providing critical analytics and proactive network management capabilities through automation to increase its customers’ ability to troubleshoot and remediate their environments.

It also continues to invest in silicon and optics to build the next generation Internet for customers. The recently announced intent to acquire Acacia (see Event Presentation) is a good example of how CSCO is enhancing its silicon and optics portfolio to enable web scale service provider and data center operator customers to meet the increasingly fast growing consumer demand for data.

Cybersecurity continues to be the top priority for CSCO’s customers. This has resulted in CSCO reporting another consecutive quarter of double-digit growth.

CSCO is an industry leader in networking and cybersecurity and is investing in, and extending, its subscription based security innovations across its networking domains. By extending its ability to detect threats, CSCO is the only company providing an integrated end-to-end security architecture across multi-cloud environments.

In FY2019, CSCO expanded its family of cloud security solutions to help secure identity, endpoints and the network. CSCO has also extended this protection from the network to branch offices to roaming users with flexible solutions designed to secure its customers’ SD-WAN environments. This has led to accelerating customer adoption as they move or expand to the cloud.

In Q4, CSCO announced the availability of a full Web proxy capability on its global SaaS platform umbrella to complement its on-premise appliances.

In the Applications product category, CSCO’s collaboration business continues to perform well. It is leading the market in integrating AI and ML into its enterprise collaboration portfolio so as to help customers work smarter and to increase productivity.

Through its AI driven innovations like people insights, facial recognition and Webex Assistant, CSCO is driving expanded collaboration experiences on any device integrated with customers’ business process workflows. Building on these cognitive innovations, CSCO announced its intent to acquire Voicea, a market leading provider of voice-based artificial intelligence solutions. With Voicea's technology CSCO will be able to enhance its entire Webex portfolio with a powerful transcription service combining AI and automated speech recognition to enable more actionable meetings, improved productivity, and enhanced experiences.

Q4 and FY2019 Financial Results

CSCO’s results released August 14th can be found here and its accompanying Earnings Presentation can be found here.

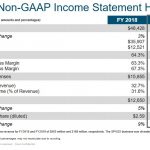

Source: CSCO – Q4 and FY2019 Earnings Presentation – August 14, 2019

On the Q4 Earnings call, management indicated that CSCO experienced continued challenges in service provider space. The Americas was generally the same from an order perspective from Q3, Europe was positive, and in Asia there was continued weakening in the China service provider business. In addition, CSCO had two massive build outs in India in FY2018 which were not replicated in FY2019.

Given the ongoing US/China trade discussions situation which is front and center in the media every day, it was not surprising to have some analysts question the impact on CSCO’s business.

Management indicated that less than 3% of its business is derived from China. While this is a very small percentage, the dramatic drop in business derived from China will inevitably impact CSCO’s results and the drop-off was more significant than management had expected; management has indicated that CSCO is not being allowed to even participate in any bids issued by state-owned enterprises.

Q1 2020 Guidance

CSCO only provides guidance for the upcoming quarter.

Q1 guidance (normalized to exclude the divested SPVSS business) is as follows:

- Q1 FY 2020 Revenue 0% - 2% growth;

- Y/Y Non-GAAP gross margin rate: 64% - 65%;

- Non-GAAP operating margin rate: 32% - 33%;

- Non-GAAP tax provision rate: 20%;

- Non-GAAP EPS: $0.80 - $0.82;

- GAAP EPS: $0.64 - $0.69.

Revenue for the divested SPVSS business for Q1 2019 was $0.168B.

Credit Ratings

There have been no changes to CSCO’s credit ratings subsequent to my previous article. Moody’s rates CSCO’s long-term debt A1 (top tier of the upper medium grade range) and S&P Global rates it AA- (bottom tier of the high grade range).

I have no reason to suspect CSCO will be unable to service its obligations.

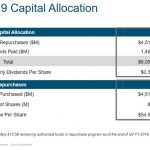

On the Q4 Earnings call clarification was provided on CSCO’s capital return plan.

When the US tax reform was brought about, CSCO announced a $31B share buyback authorization. This authorization was effectively used up with cash, cash equivalents and investments of ~$72B at the end of January 2017 now having been reduced ~$33.4B as at FYE2019.

CSCO’s management has indicated that with the significant reduction in its debt over the past couple of years we can now expect it to revert to its normal strategy which entails opportunistic share repurchases where its share price takes a hit (I hope August 15th was such a day). Otherwise, the plan is to balance share buybacks and dividends to be at least 50% of free cash flow; FCF in recent years has been ~$12B/year).

CSCO’s dividend and stock split history can be found here.

CSCO’s 3rd quarterly $0.35 dividend will be declared mid-September and the 4th in early December. On the basis of $1.40/year and a ~$46.25 share price, the dividend yield is ~3% which is slightly higher than 2017 and 2018 levels.

I anticipate CSCO will increase its quarterly dividend to $0.37 when CSCO declares its dividend in early February 2020. While this will not result in a significant increase in CSCO’s dividend yield (based on the current share price), investors can take comfort that CSCO generates ample Free Cash Flow so the risk of a dividend cut is extremely low.

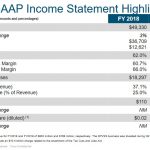

In addition to dividend increases, CSCO rewards its investors in the form of share repurchases and in Q4 alone CSCO did the following:

Source: CSCO – Q4 and FY2019 Earnings Presentation – August 14, 2019

The following reflects the weighted average number of diluted shares outstanding (in millions) in FY2014 – FY2019: 5281, 5146, 5088, 5049, 4881, and 4453.

Valuation

In my May 21st article I compared CSCO’s current valuation relative to historical valuation on the basis of non-GAAP EPS.

February 15, 2017 article - CSCO was trading at $32.82 and forward adjusted EPS guidance was ~$2.34 giving us a forward adjusted PE of ~14.

May 19, 2018 article - CSCO was trading at $43.21 and forward adjusted EPS guidance was ~$2.48 giving us a forward adjusted PE of ~17.42.

August 16, 2018 article - CSCO was trading at $45.38 and forward adjusted EPS guidance was ~$2.97 giving us a forward adjusted PE of ~15.28.

March 13, 2019 article – CSCO was trading at $52.59 and forward adjusted EPS guidance was ~$3.02 giving us a forward diluted PE of ~17.41. The mean adjusted diluted EPS guidance from 30 brokers was $3.07, however, thus giving us a forward adjusted diluted PE of ~17.13.

In my May 21, 2019 article I indicated that CSCO had generated $2.26 in YTD non-GAAP EPS and Q4 guidance was $0.80 - $0.82 thus giving us full year projected non-GAAP EPS of $3.06 - $3.08; guidance from 29 brokers ranged from $3.07 - $3.11 with a mean of $3.08. Using $3.07 and with shares trading at $56.52 I arrived at a forward adjusted PE of ~18.41.

At the time of that May article FY2020 diluted adjusted EPS estimates from 29 analysts ranged from $3.26 - $3.51 with the mean being $3.41. Using the $56.52 share price I arrived at a forward adjusted diluted FY2020 PE of ~16.57.

Let’s look at CSCO’s valuation based on current FY2020 guidance.

CSCO only provides guidance for the upcoming quarter, and therefore, I will use adjusted forward diluted EPS guidance from multiple analysts. The high, low, and mean estimates from 28 analysts for FY2020 are now $3.49, $3.26, and $3.35 versus actual FY2019 adjusted diluted EPS of $3.10.

Q1 2020 non-GAAP guidance is $0.80 - $0.82 and while earnings will fluctuate on a quarterly basis, $3.35 does not appear to be unreasonable full-year guidance. Using the current $46.25 share price we get high, low, and mean forward adjusted PEs of ~13.3, ~14.2, and ~13.8.

On a GAAP basis, CSCO reported FY2019 diluted EPS of $2.71. If CSCO’s GAAP earnings were to increase 4% we would arrive at forward GAAP EPS of ~$2.71; remember that CSCO intends to balance share buybacks and dividends to be at least 50% of free cash flow with FCF in recent years having been ~$12B/year. Using the current $46.25 share price we get a forward diluted PE of ~17.07.

I view forward PE levels based of FY2020 non-GAAP and GAAP estimates as being attractive.

Final Thoughts

Investing in tech is certainly not without risk and increased volatility over the short-term should not be ruled out.

Source: MarketWatch

This is why I recommend investors stick with high quality companies and that they pare back ‘riskier’ positions.

While CSCO could certainly experience a bumpy ride in the short-term this is a company which consistently generates strong FCF and which has weathered previous challenging business environments.

With CSCO’s share price having pulled back ~8.6% from the August 14th market close to close at $46.25 on August 15th, I now view shares to be attractively valued. On this basis I have acquired another 400 shares on August 15th for one of the ‘Side Accounts’ within the FFJ Portfolio; 811 shares acquired at an average cost of ~$19.50 are held in one of the ‘Core Accounts’ within the FFJ Portfolio.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CSCO.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.