Contents

I view the Canadian National Railway Company (CNR) as a core long-term holding.

This article looks at CNR's valuation based on Q2 2019 results released July 23, 2019 and FY2019 guidance provided at the June 3 - 4 2019 Investor Day.

Summary

- I view CNR as the premier Class 1 North American railroad in that it typically has the best Operating Ratio.

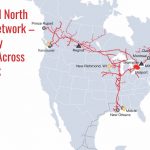

- CNR employs ~6,400 people and operates ~20,500 route-miles of track spanning Canada and mid-America and connecting three coasts: the Atlantic Coast, the Pacific Coast, and the Gulf of Mexico.

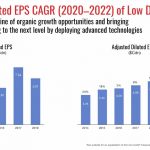

- CNR is targeting $1.3B to $2.4B of Incremental Revenue Opportunities in 2020 - 2022

- CNR has a balanced portfolio with freight revenue diversified over 7 different commodity groups. No individual commodity group accounts for more than 23% of annual revenue.

NOTE: All figures are expressed in Canadian dollars.

Full Disclosure: CNR shares are held in the ‘Core’ and ‘Side’ accounts within the FFJ Portfolio.

Introduction

I like the rail industry from an investment standpoint because the entry barriers are high. When I initially decided to acquire exposure to the Class 1 railroads I opted to invest in Canadian National Railway Company (CNR) because it typically was the most efficient operator; other Class 1 railroads were undertaking efforts to narrow the gap between their respective operating ratio and that of CNR.

In my previous April 30th article I shared that I was of the opinion CNR shares were richly valued. I, therefore, decided to execute the option trades presented in that article.

How have those trades panned out?

I essentially broke even on the Bear Call Spread Option trade.

As far as the $125 September 2019 covered call trade goes, I generated $4.30/share. If I wished to close out these contracts today, I would need to lay out $2.13/share. I am currently ahead $2.17/share but anything can happen between now and the September 20th expiry. The fact I sold options means that I benefit from the evaporation of time and the rate at which the time value element of the option diminishes increases as we approach expiry.

I now take this opportunity to briefly review CNR given that it:

- held its Investor Day on June 3 – 4 and provided investors with its outlook for 2020 – 2022;

- released Q2 and YTD results following the July 23rd market close.

2019 Investor Day

CNR has an impressive North American rail network with potential for ongoing capacity expansion for years to come.

In fact, management has estimated the following incremental growth opportunity for 2020 – 2022:

Source: CN Rail 2019 Investor Day Presentation – June 3 – 4, 2019

Through a disciplined target selection process, CNR is pursuing Rail-Centric, Intermodal and Logistics, and Port Partnership strategic growth opportunities to help its customers get their products to market more efficiently, to extend its reach, and to increase network volume.

The March 2019 acquisition of Winnipeg-based The TransX Group of Companies, one of Canada’s largest and oldest transportation companies is an example of how CNR is deepening its supply chain focus.

CNR and TransX have been supply chain partners for several years and with the acquisition of TransX, CNR will continue to support the wholesale and beneficial cargo owner customers including the growing, service-sensitive, refrigerated transportation business.

In May 2019, CNR's joint bid for the largest container terminal in Eastern Canada hit a snag after Singapore-based port operator PSA International Pte Ltd. acquired the Halterm terminal at the Port of Halifax, scuttling CNR’s plans to create ‘a Prince Rupert of the East’ as part of the plan to acquire more non-rail assets. Recently, however, the Quebec Port Authority has signed a long-term commercial agreement with Hutchison Ports and CNR, to build and operate a new container terminal, known as project Laurentia (previously Beauport 2020).

CNR is also deploying advanced technologies to drive value. Further information on CNR’s initiatives to improve safety, reliability and predictability can be found here and on pages 75 – 80 of the CN Rail 2019 Investor Day Presentation for which a link has been provided above.

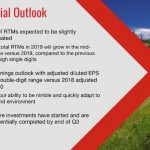

Management provided the following FY2019 Outlook at CNR’s Investor Day.

RTM = Revenue Ton-Miles

Source: CN Rail 2019 Investor Day Presentation – June 3 – 4, 2019

Q2 2019 Results and FY2019 Guidance

CNR’s Q2 Earnings Release, Earnings Presentation, and non-GAAP Measures can be accessed here.

Source: CNR Q2 2019 Earnings Release - July 23 2019

Credit Ratings

There has been no change to CNR’s long-term debt credit ratings subsequent to my April 30th article nor do I see any indication that ratings are under review.

Moody’s continues to rate CNR’s senior unsecured long-term debt A2 which is the middle tier of the ‘upper medium grade’ rating.

S&P Global rates CNR’s senior unsecured long-term debt A which is the middle tier of the ‘upper medium grade’ rating.

I continue to view these ratings as attractive.

Valuation

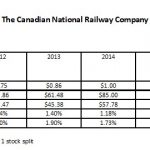

In my April 30th article I wrote that CNR’s management has indicated that it expects to deliver adjusted diluted EPS growth in the low double-digits range versus 2018 adjusted diluted EPS of $5.50; I increased FY2018’s adjusted EPS by 10% - 13% to arrive at a $6.05 - $6.22 adjusted diluted EPS range for FY2019.

As I compose this article, shares are currently trading at ~$123.70. Based on estimated $6.05 - $6.22 adjusted diluted EPS for FY2019, the current forward adjusted diluted PE is in the range of ~19.9 - ~20.44.

CNR’s diluted PE in recent years has typically been in the teens with the exception of 2014 when it was 22.41 and 2017 when it was 20.32. We know that CNR’s FY2018 diluted EPS came in at $5.87 so let’s increase this by 10% - 13% as we did with the adjusted diluted EPS. In doing so we get a projected diluted EPS range of $6.48 - $6.63.

For the first half of FY2019, CNR generated $2.96 in diluted EPS and $2.90 in adjusted diluted EPS (page 1 of Q2’s Non-GAAP Measures document) so doubling the first half’s $2.96 of diluted EPS gives us $5.92. To reach a projected diluted EPS range of $6.48 - $6.63 will require CNR to be firing on all cylinders in the second half of FY2019. I am not disputing this is achievable given the various initiatives on the go so if we use the current ~$123.70 share price and the projected diluted EPS range of $6.48 - $6.63 we get a forward diluted PE range of ~18.65 - ~19.09.

I view CNR’s forward valuation as being just a tad rich for my liking. A price of $120 and $6.63 in diluted EPS would give us a forward diluted PE of ~18.1. Still not ‘on sale’ but better than the current valuation following the ~$4/share spike in CNR’s share price following the release of Q2 results.

Dividend and Dividend Yield

CNR’s dividend history can be found here. With a quarterly dividend of $0.5375 or $2.15/year and shares trading at ~$123.70 investors receive a ~1.73% dividend yield.

This chart shows how CNR’s current dividend yield compares to the dividend yield of recent years.

Looking at the dividend yield based on the high/low stock price for the last few years it would appear there is an opportunity for the current dividend yield to improve slightly. In order for this to happen a weakening in CNR’s share price would need to occur.

Final Thoughts

In my opinion, CNR is one of the best Class A railroads in North America and I fully intend to hold shares for the long-term.

I am certainly open to increasing my position even though it is already one of my top 20 holdings. My concern at this stage is that the broad market is overheated. I am, therefore, patiently waiting for what I think is an overdue market pullback.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected]

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CNR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.